Loading

Get Ohio Cat Form And Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio Cat Form And Instructions online

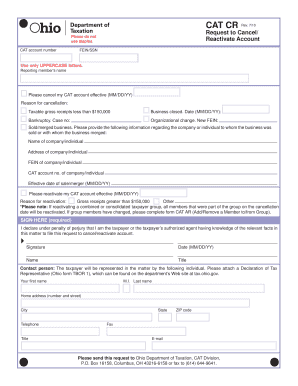

The Ohio Cat Form is used to request the cancellation or reactivation of a CAT account. This guide provides a clear step-by-step approach to help users complete the form online efficiently and accurately.

Follow the steps to complete the Ohio Cat Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your CAT account number in the designated field. Ensure that you use only uppercase letters as specified.

- Fill in your FEIN or SSN carefully in the appropriate section.

- Complete the reporting member's name, ensuring it matches the name associated with the account.

- Indicate your request to cancel your CAT account by checking the box and providing the effective cancellation date in MM/DD/YY format.

- Select the reason for cancellation from the options provided, such as 'Taxable gross receipts less than $150,000' or 'Business closed.' Include any additional necessary information as prompted.

- If applicable, include details regarding bankruptcy, organizational changes, or sales/mergers by filling in the respective sections for company or individual information.

- If you are requesting reactivation, check the appropriate box and fill in the effective reactivation date.

- Select the reason for reactivation, such as 'Gross receipts greater than $150,000' or 'Other.'

- Sign the form in the designated area to certify that you are the taxpayer or authorized agent.

- Provide the date of signing and your name along with your title.

- If necessary, fill in the contact person's details and attach the required declaration of tax representative.

- After reviewing all the entries, you can save changes, download the completed form, print it, or share it as needed.

Complete your Ohio Cat Form online to ensure your account is managed correctly.

You can obtain 1040 tax forms from the IRS website, local tax offices, or public libraries. Many tax preparation services also provide these forms during tax season. If you're looking for the Ohio Cat Form and Instructions alongside your 1040 forms, US Legal Forms can help you find everything you need.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.