Loading

Get Affidavit Of Non Ohio Domicile Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Affidavit Of Non Ohio Domicile Form online

This guide provides a comprehensive overview of how to fill out the Affidavit of Non-Ohio Domicile Form online. Whether you are new to filing tax documents or require assistance, this step-by-step approach will help ensure that you complete the form accurately and efficiently.

Follow the steps to complete your affidavit online.

- Click the ‘Get Form’ button to obtain the affidavit and open it for editing.

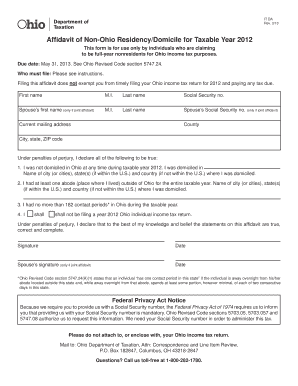

- Begin by entering your first name, middle initial (if applicable), and last name in the corresponding fields. This information identifies you as the filer.

- Input your Social Security number. Ensure that you enter this information accurately as it is required for tax processing.

- If filing a joint affidavit, provide your partner’s first name, middle initial, and last name, along with their Social Security number.

- Fill in your current mailing address, including county, city, state, and ZIP code to ensure that any correspondence reaches you.

- Under penalties of perjury, declare that you were not domiciled in Ohio during taxable year 2012 by indicating the name of cities, states, and countries where you were domiciled.

- Indicate that you had at least one place where you lived outside of Ohio for the entire taxable year by naming the relevant city, state, and country.

- Confirm that you had no more than 182 contact periods in Ohio during the taxable year by reviewing and providing accurate details.

- Indicate whether you shall or shall not be filing a year 2012 Ohio individual income tax return. This helps clarify your tax status.

- Review all declarations carefully before signing. Once you are confident that all information is accurate, sign the affidavit and include the date of your signature.

- If applicable, ensure your partner also signs the affidavit and includes the date of their signature.

- After completing the affidavit, you can save your changes, download a copy, print the form, or share it as necessary.

Complete your affidavit online today to ensure timely processing and compliance with Ohio tax regulations.

Under Ohio law, taxpayers are presumed to be non-Ohio residents if they meet 3 requirements: 1) have an abode or place of residence outside Ohio during the entire taxable year, 2) have no more than 212 contact periods in Ohio during the taxable year, and 3) file a non-Ohio residency affidavit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.