Get Nj Division Of Revenue C113 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nj Division Of Revenue C113 Form online

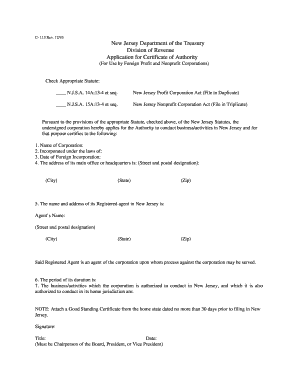

This guide provides a clear and straightforward approach to completing the Nj Division Of Revenue C113 Form online. Whether you are a foreign profit or nonprofit corporation seeking to establish authority to operate in New Jersey, these steps will assist you in navigating the form efficiently.

Follow the steps to successfully fill out the Nj Division Of Revenue C113 Form.

- Click ‘Get Form’ button to acquire the form and open it in the editor.

- Begin by checking the appropriate statute relevant to your corporation type. Indicate whether you are filing under the New Jersey Profit Corporation Act or the New Jersey Nonprofit Corporation Act.

- Enter the name of your corporation in the designated field.

- Provide the state under which your corporation is incorporated in the corresponding section.

- Input the date of your foreign incorporation accurately.

- Fill in the main office or headquarters address, including street, city, state, and zip code.

- Supply the name and address of your registered agent in New Jersey, ensuring all fields are complete.

- Indicate the period of your corporation's duration.

- Clearly outline the business activities authorized in New Jersey and confirm they match those permitted in your home jurisdiction.

- Attach a Good Standing Certificate from your home state, dated no more than 30 days prior to your filing in New Jersey.

- Complete the signature, title, and date fields, ensuring that the signatory is the Chairperson of the Board, President, or Vice President of the corporation.

- Once all sections are filled, save the changes, download the form, print it for your records, or share it, as necessary.

Complete your documents online with confidence and ensure your business is authorized to operate in New Jersey.

You can find NJ Division of Taxation tax forms on the official New Jersey Division of Taxation website. They offer a comprehensive collection of forms for various tax-related needs, making it easy for you to access what you require. Additionally, platforms like USLegalForms provide the NJ Division Of Revenue C113 Form and other essential documents, ensuring you have the right forms at your fingertips for your specific tax situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.