Loading

Get How To Fill Out A Ma 355s Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Out A Ma 355s Form online

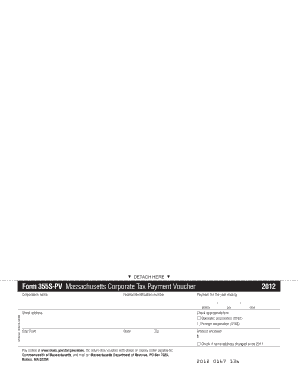

Filling out the Ma 355s Form online can seem challenging, but with clear instructions, you will find the process straightforward. This guide will walk you through each section of the form to ensure accurate completion.

Follow the steps to successfully complete the Ma 355s Form online.

- Click 'Get Form' button to obtain the form and open it in your preferred online editor.

- Begin by entering the corporation name in the designated field. Ensure the spelling is correct as this represents your business.

- Next, input the federal identification number. This unique number identifies your corporation for tax purposes.

- Indicate the payment year by entering the month, day, and year for which you are filing, ensuring you use the correct format.

- Provide the complete street address of the corporation, including city or town and state, in the specified fields to ensure accurate correspondence.

- Enter the zip code associated with the address provided in the previous step.

- Select the appropriate box to indicate whether the corporation is domestic or foreign. This is important for determining tax obligations.

- Fill in the amount of money enclosed with this voucher. Make sure this accurately reflects your tax payment.

- If there has been a change in the corporation's name or address since the previous year, check the corresponding box.

- Once all fields are completed, review your form for accuracy. You can then save your changes, download, print, or share the form as needed.

Start completing your Ma 355s Form online today to ensure timely processing.

Any business entity, including S-Corps, that generates income in Massachusetts must file a state tax return. This includes both residents and non-residents who conduct business in the state. Filing your return accurately is crucial to avoid penalties, and platforms like uslegalforms can assist you with understanding how to fill out a MA 355S form for tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.