Loading

Get Allotment Information - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Allotment Information - Mass online

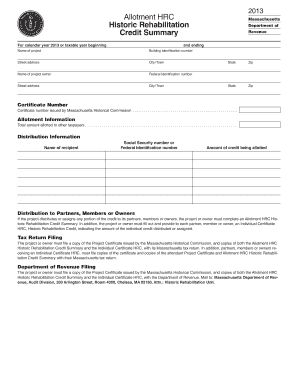

The Allotment Information - Mass form is essential for reporting the distribution of credits received through the Historic Rehabilitation Credit program. This guide provides a clear, step-by-step approach to ensure that users can accurately complete the form online, facilitating compliance with state requirements.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the project in the designated field to identify the rehabilitation activity being reported.

- Fill in the building identification number to specify the structure associated with the credit.

- Provide the full street address, including city or town, where the project is located to ensure proper identification.

- In the section for the project owner, input their name and federal identification number to ensure accurate ownership records.

- Complete the street address, city or town, state, and zip code of the project owner to confirm their contact details.

- Enter the certificate number issued by the Massachusetts Historical Commission, which is crucial for validation.

- Specify the total amount allotted to other taxpayers in the relevant field to detail the distribution of credits.

- For each recipient, input their name and either social security number or federal identification number to track credit allocations.

- Indicate the amount of credit being allotted to each recipient to clarify and record the distribution.

- If applicable, complete the section regarding distribution to partners, members, or owners and outline the required certificates for them.

- Once all fields are completed, review the form for accuracy before saving your changes, downloading, printing, or sharing the completed form.

Begin filling out the Allotment Information - Mass form online today to ensure timely submission!

When do benefits expire? DTA benefits roll over month to month. Cash benefits not used for 90 days or more expire and are removed from your EBT card. SNAP benefits will not be removed from your card if you use your benefits any time within 274 days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.