Get State Of Maine Substitute W-9 & Vendor Authorization Form - Maine.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the State Of Maine Substitute W-9 & Vendor Authorization Form - Maine.gov online

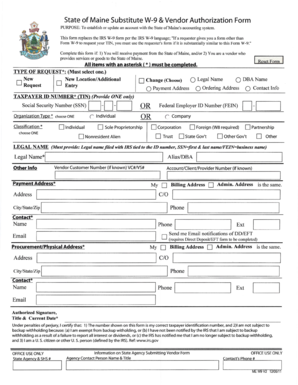

The State Of Maine Substitute W-9 & Vendor Authorization Form is essential for individuals and organizations receiving payments from the State of Maine. This guide provides comprehensive instructions on how to complete the form online, ensuring you accurately provide the necessary information.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the type of request. You need to select one option from the choices provided, such as 'New Request', 'New Location/Additional Entry', or 'Change'.

- Select the type of entity that is submitting the form. You can choose from options including 'Organization', 'Individual', 'Sole Proprietorship', 'Nonresident Alien', or 'Other'.

- Fill in the legal name of the legal entity or individual, along with any aliases or DBA names if applicable. You may also include your vendor customer number if known.

- Input the taxpayer identification number. You should provide either your Social Security Number (SSN) or your Federal Employer ID Number (FEIN). Only one identifier is required.

- Complete your contact information, including your phone number and email address. You may opt for email notifications regarding payments if direct deposit is selected.

- Sign and date the form. By signing, you certify that the information provided is accurate and that you are not subject to backup withholding.

- Review all entered information for accuracy. Once confirmed, you can save your changes, download, print, or share the completed form as required.

Complete the State Of Maine Substitute W-9 & Vendor Authorization Form online today to ensure you can receive payments without delay.

The state vendor number for Maine is a unique identifier assigned to businesses that register as vendors with the state. You will receive this number after completing the State Of Maine Substitute W-9 & Vendor Authorization Form - Maine and getting your application approved. This number is essential for processing payments and facilitating transactions with state agencies. If you have questions about your vendor number, you can contact the Maine Bureau of Purchases for assistance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.