Get 2013 Ma Ifta Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Ma Ifta Application Form online

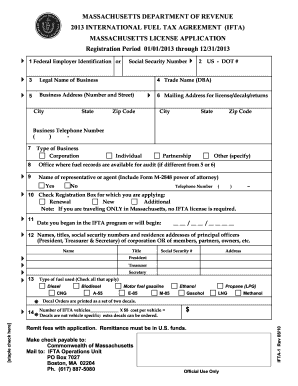

Filling out the 2013 Massachusetts International Fuel Tax Agreement (IFTA) Application Form online is an essential process for businesses operating qualified motor vehicles across multiple jurisdictions. This guide provides you with step-by-step instructions to ensure your application is completed accurately and promptly.

Follow the steps to successfully complete the application form.

- Press the ‘Get Form’ button to access the application form and open it in your online editor.

- Complete Line 1 by entering your Federal Employer Identification Number or Social Security Number if applicable.

- Input your US DOT Number on Line 2, ensuring it is accurate for interstate operations.

- On Line 3, provide the exact legal name of your business as it appears on legal documents.

- If you operate under a trade name, fill in Line 4 with your Doing Business As (DBA) name.

- Fill out Line 5 with your business address, including street number and name, city, state, and zip code.

- If your mailing address differs from your business address, provide the mailing address in Line 6.

- Indicate the type of business (corporation, individual, partnership, or other) on Line 7.

- State where your fuel records can be audited in Line 8, if different from previous lines.

- If applicable, complete Line 9 by filling out the name and contact information for your power of attorney representative.

- Check the appropriate registration type in Line 10: renewal, new, or additional.

- On Line 11, note the date you began or will begin participating in the IFTA program.

- Provide the names, titles, social security numbers, and addresses of your principal corporate officers in Line 12.

- Check all fuel types used on Line 13.

- In Line 14, enter the number of IFTA vehicles and calculate the total fee by multiplying by $8.

- Mark the jurisdictions where you travel on Line 15 by placing an 'X' in the applicable boxes.

- Indicate whether you maintain bulk storage in Line 16 and list the jurisdiction if applicable.

- In Line 17, list any IFTA jurisdictions where you are currently or have been previously registered.

- Answer whether your IFTA license has ever been revoked in Line 18.

- If applicable, list any jurisdiction where your IFTA license is currently revoked in Line 19.

- Ensure the application is signed by an authorized individual and enter their title, telephone number, and date at the bottom.

- Review the entire application for completeness, verifying your check amount, and ensure all necessary signatures are included.

- Finally, you can save changes, download the form, print it, or share it as needed.

Complete your IFTA application online to ensure your compliance and streamline your fuel tax reporting.

To figure out IFTA, calculate the total miles driven and the total gallons of fuel purchased in each state. Then, use this information to determine your tax liability based on the IFTA rates for each state. Completing the 2013 MA IFTA Application Form will help consolidate these figures into a single report. If you need assistance, uslegalforms provides resources and tools to help you navigate the IFTA process easily.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.