Get Annualization Massachusetts Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Annualization Massachusetts Form online

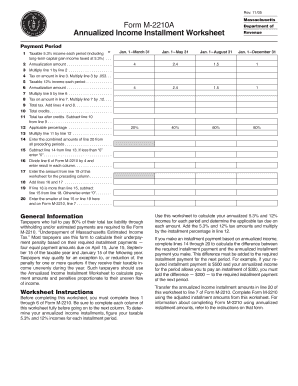

Filling out the Annualization Massachusetts Form correctly is essential for accurately reporting your taxes, especially if your income varies during the year. This guide provides step-by-step instructions to help you complete the form online with confidence.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by completing Form M-2210 lines 1 through 6 fully before proceeding to the Annualized Income Installment Worksheet.

- For each installment period, calculate your 5.3% and 12% taxable incomes, and enter these amounts in the corresponding sections of the worksheet.

- Multiply the 5.3% income by the applicable installment percentages provided in the worksheet to calculate the tax due for that segment.

- Repeat the calculation for the 12% income, documenting the results in the respective lines of the worksheet.

- Add the taxes calculated for both the 5.3% and 12% incomes to determine your total tax for that installment period.

- Transfer the amounts calculated in line 20 of the worksheet to line 7 of Form M-2210, ensuring all entries are accurate.

- After completing all relevant sections, save your changes, and consider downloading, printing, or sharing the form as needed.

Complete your filing for the Annualization Massachusetts Form online today!

Filing an annual report in Massachusetts involves completing the Annualization Massachusetts Form with accurate business information. You can submit this form online through the Massachusetts Secretary of the Commonwealth's website or by mailing a paper version. Be sure to gather all necessary documents beforehand to streamline your filing process. For added convenience, US Legal Forms provides user-friendly templates and guidance to help you navigate your annual report submission effortlessly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.