Get 355 7004 Misc Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 355 7004 Misc Form online

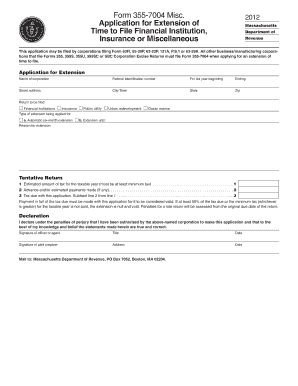

The 355 7004 Misc Form allows corporations to apply for an extension of time to file various tax returns in Massachusetts. Accurate completion of this form is essential to ensure compliance and avoid penalties. This guide provides step-by-step instructions for filling out the form online.

Follow the steps to complete the 355 7004 Misc Form online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Enter the name of the corporation in the designated field. Ensure this matches the official name registered with the Department of Revenue.

- Input the federal identification number of the corporation. This is essential for identification purposes.

- Fill in the tax year beginning and ending dates. It is important to provide the exact dates to avoid confusion.

- Complete the street address, city or town, state, and zip code of the corporation.

- Select the type of return to be filed from the options provided: financial institutions, insurance, public utility, urban redevelopment, or ocean marine.

- Indicate the type of extension being applied for; either an automatic six-month extension or an extension until a specified date.

- Provide the reason for the extension request in the designated field.

- Complete the tentative return section by entering the estimated amount of tax for the taxable year, advance and/or estimated payments made, and calculating the tax due with this application.

- Ensure that full payment of the estimated tax due accompanies the application. This is required for the application to be valid.

- Sign the declaration at the bottom of the form, indicating the authority to submit this application on behalf of the corporation. Include the title, signature, and date of the officer or agent.

- If applicable, the paid preparer should also sign, provide their address, and date the form.

- After completing the form, save your changes. You may also download or print the form for your records.

- Finally, mail the completed form to the Massachusetts Department of Revenue at the provided address.

Begin filling out the 355 7004 Misc Form online today to ensure your extension is processed efficiently.

Form 355-7004 is a specific Massachusetts tax form that allows corporations to apply for an automatic extension to file their corporate tax return. This form is critical for corporations that need extra time to gather their financial information. By utilizing the 355 7004 Misc Form, you can minimize stress and ensure that you meet your tax obligations. For easy access and guidance, consider using the US Legal Forms platform to navigate your filing process efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.