Loading

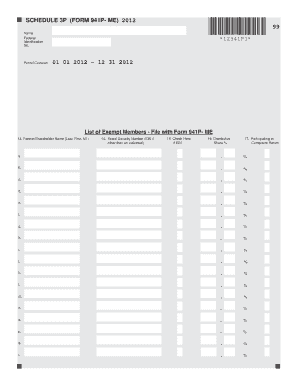

Get Schedule 3p Maine Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule 3p Maine Form online

Filling out the Schedule 3p Maine Form is a crucial step for reporting exempt members in your business. This guide provides easy-to-follow instructions to assist you in completing the form online, ensuring that all required information is accurately reported.

Follow the steps to successfully complete the Schedule 3p Maine Form

- Click ‘Get Form’ button to obtain the Schedule 3p Maine Form and open it in your preferred editable format.

- Enter your name in the designated field under 'Name'. This should be the name associated with the federal identification number.

- Input your federal identification number in the respective field labeled 'Federal Identification No.'. Make sure the number is accurate to prevent processing errors.

- Specify the period covered by indicating the start and end dates, as shown in the form. For example, enter '01 01 2012 - 12 31 2012' for the relevant tax year.

- List each exempt member by providing their name in the fields under 'Partner/Shareholder Name (Last, First, MI.)'. Ensure that each entry is clear and correctly formatted.

- For each member listed, enter the corresponding Social Security Number or Employer Identification Number (EIN) where applicable.

- Check the box labeled 'Check Here if EIN' for any individual that has an EIN instead of a Social Security Number.

- Indicate the distributive share percentage for each listed partner or shareholder in the 'Distributive Share %' field. Be precise as this will reflect their share of the income.

- Confirm if any of the listed members are participating in a composite return by marking the appropriate box.

- Continue entering any additional exempt members as needed, following the same format for each entry.

- Once all information is filled out, verify the accuracy of the details. You can then save changes, download a copy, print it for your records, or share the completed form with the relevant tax authorities.

Start completing your Schedule 3p Maine Form online today for accurate and efficient tax reporting.

How do I register to remit Maine income tax withholding? You can download a registration application on the MRS General Forms Page or order an application by calling (207) 624-7894. You may also register electronically on the Maine Tax Portal (click on Register a Business.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.