Loading

Get Note: If Either Spouse Is Deceased, Enter The Date Of Death On Form 1040me, Page 3 In The Spaces

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

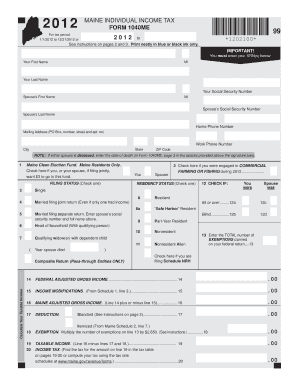

How to fill out the note for deceased spouse on Form 1040ME, Page 3 online

This guide provides comprehensive instructions on how to fill out the note regarding the date of death of a spouse on Form 1040ME. It aims to assist users in understanding each step of the process, ensuring that the information is submitted accurately and efficiently.

Follow the steps to accurately complete the form online.

- Click ‘Get Form’ button to download the form and access it in the document editor.

- Navigate to page 3 of Form 1040ME, where you will find the section for entering the date of death.

- Locate the area labeled 'IMPORTANT NOTE' which specifies to enter the date of death if either taxpayer is deceased.

- If your spouse is deceased, fill in the spaces provided for the date of death with the correct month, day, and year.

- Carefully review the entered information to ensure accuracy before proceeding.

- Once all relevant information has been entered, save your changes.

- After saving, you can choose to download, print, or share the completed form as needed.

Complete your Form 1040ME online today for a smooth filing experience.

To report your spouse's death to the IRS, you should include the date of death on the tax return for the year they passed away. This information can be entered on Form 1040ME, Page 3 in the appropriate spaces. It is an essential step in ensuring the IRS has accurate records, simplifying the tax process for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.