Loading

Get Form 126 Iowa 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 126 Iowa 2012 online

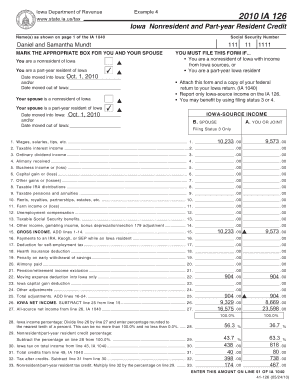

Filling out Form 126 Iowa 2012 is essential for nonresidents and part-year residents to report their Iowa-source income and claim the appropriate credits. This guide provides clear instructions to assist you in completing the form accurately online.

Follow the steps to successfully complete your Form 126 Iowa 2012 online.

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your name(s) as shown on your federal tax return in the designated field.

- Input your Social Security Number in the specified area.

- Mark the appropriate box to indicate your residency status in Iowa, as well as that of your spouse if applicable.

- Fill in the date you moved into Iowa and, if applicable, your date of departure from Iowa.

- List your Iowa-source income in the appropriate sections, detailing each income type such as wages, taxable interest, and any business income.

- Calculate your total gross income by adding the amounts from the listed income lines.

- Enter any adjustments applicable to your income, like IRA contributions or self-employment deductions.

- Subtract the total adjustments from your gross income to determine your Iowa net income.

- Divide your Iowa net income by your total all-source net income to calculate your Iowa income percentage.

- Calculate the nonresident/part-year resident tax credit percentage by subtracting the Iowa income percentage from 100%.

- Refer to your total income tax calculations from your IA 1040 form and apply the nonresident/part-year resident tax credit percentage.

- Make sure to check all entries for accuracy and completeness before submission.

- Once completed, save your changes and choose to download, print, or share your form as needed.

Start filing your Form 126 Iowa 2012 online today for a smoother tax experience!

Calculating income for a part-year resident involves determining the income earned during the period you resided in Iowa. You need to report only the income earned while you were a resident. Use Form 126 Iowa 2012 to detail this income and ensure that your tax return reflects your correct residency status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.