Get Ia 1040c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ia 1040c online

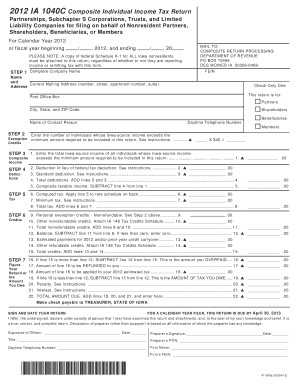

This guide provides clear and detailed instructions on how to effectively fill out the Ia 1040c form online. Designed for partnerships, Subchapter S corporations, trusts, and limited liability companies, this form captures crucial tax information for nonresident partners, shareholders, beneficiaries, or members.

Follow the steps to complete your Ia 1040c form online.

- Click 'Get Form' button to access the Ia 1040c and open it in your document editor.

- Complete the company name and current mailing address. Ensure to include the FEIN. Then, check only one box to indicate whether the return is for partners, shareholders, beneficiaries, or members.

- Enter the number of individuals whose Iowa-source income exceeds the minimum required for this return. Multiply this number by $40 to calculate the amount.

- Input the total Iowa-source income of all individuals meeting the above criteria. Deduct the allowable amounts for federal tax paid and the standard deduction according to the guidelines provided in the instructions.

- Calculate the composite taxable income by subtracting the total deductions from the total Iowa-source income.

- Determine the computed tax by applying the composite taxable income to the appropriate rate schedule. Also, assess whether any minimum tax applies and include it as well.

- Fill in applicable nonrefundable credits and see if they can reduce your overall tax liability.

- Calculate any overpayment by subtracting the balance from total credits, or establish the total amount due based on any outstanding tax obligations.

- Sign and date your form before submission, ensuring it is complete and accurate.

Complete your Ia 1040c form online today to ensure timely processing.

An Iowa composite return is a tax return filed on behalf of a group of non-resident partners or shareholders who earn income from an Iowa source. This return simplifies the tax process for those groups, allowing a single entity to handle tax obligations. If you are navigating Iowa tax regulations, the Ia 1040c can help clarify your filing requirements and ensure compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.