Get Connecticut Form Ct 1120 Xch

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Connecticut Form CT 1120 Xch online

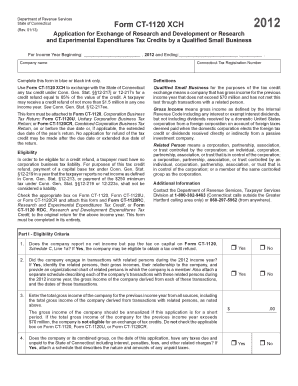

This guide provides a clear and supportive framework for completing the Connecticut Form CT 1120 Xch, which is used for exchanging research and experimental expenditures tax credits by qualified small businesses. Following this step-by-step approach will help ensure accurate submission.

Follow the steps to complete the Connecticut Form CT 1120 Xch.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin by filling in the income year details. Enter the start and end dates for the income year at the top of the form. This should clearly reflect the period for which you are applying.

- Provide your Connecticut tax registration number and company name in the designated fields. Ensure correct spelling and information accuracy.

- In Part I - Eligibility Criteria, answer the questions regarding net income and related persons. For each question, select either 'Yes' or 'No' based on your company’s situation. If applicable, prepare any required attachments that detail related persons and transactions.

- Enter the total gross income for the previous income year in the specified field. This figure should include all sources and be annualized if it is for a short income year.

- Proceed to Part II - Computation of Exchange Amount. Fill in the relevant amounts from previous forms CT-1120RC or CT-1120 RDC, as requested. Make sure to perform the calculations accurately, following the instructions given for each line.

- Complete Part III by gathering the required attachments. Provide detailed schedules supporting your claimed research expenditures, including descriptions of research projects, methods utilized, sources of information, and employee details.

- Finally, review the entire form for completeness and accuracy. Save your changes, and you can download, print, or share the form as needed for submission.

Take the steps necessary to compete your tax credit exchange online with confidence.

When you need to send a check for your Connecticut state taxes, address it to the 'Connecticut Department of Revenue Services.' Ensure that you include your Connecticut Form CT 1120 Xch number on the check to avoid any delays in processing. This helps the state easily identify your payment and apply it to your account. For more streamlined tax management, consider using US Legal Forms for access to accurate forms and guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.