Loading

Get It40ez Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It40ez Form online

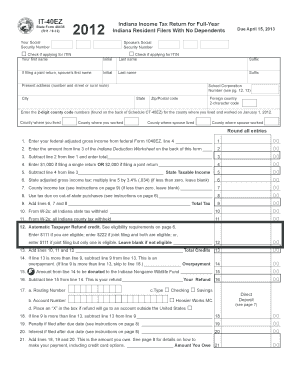

Filling out the It40ez Form online is a straightforward process designed for full-year Indiana residents with no dependents. This guide will walk you through each section of the form, ensuring that you have the necessary information to complete your tax return accurately.

Follow the steps to complete your It40ez Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your social security number in the designated field. If you are applying for an Individual Taxpayer Identification Number (ITIN), mark the checkbox provided.

- Fill in your name, initials, last name, and any suffix applicable. If you're filing jointly, repeat this for your spouse, including their name and last name.

- Enter your current address, including the number and street or rural route, city, state, and zip/postal code, as well as any foreign country code if applicable.

- Complete the section on county codes by entering the 2-digit county code for where you lived and worked as of January 1, 2012. Also, provide the relevant codes for your spouse.

- For income calculations, input your federal adjusted gross income as reported on your federal Form 1040EZ in the appropriate field.

- Enter the amount from the Indiana Deduction Worksheet in the next line, then perform the subtraction between your federal adjusted gross income and the amount just entered.

- Indicate the exemption amount based on your filing status: $1,000 for single or $2,000 for joint returns.

- Subtract the exemption amount from your taxable income to find your state taxable income.

- Calculate your state adjusted gross income tax by multiplying your state taxable income by 3.4%. If this total is less than zero, leave it blank.

- Fill in the county income tax, if applicable, by referring to the instructions, leaving it blank if it's less than zero.

- Enter the use tax due for any out-of-state purchases you made.

- Add the totals from the previous three lines to determine your total tax responsibility.

- Input any Indiana state tax withheld from your W-2 statements in the next field.

- If applicable, enter the county tax withheld from your W-2s.

- Assess your eligibility for the Automatic Taxpayer Refund credit, and enter the appropriate amount if eligible.

- Calculate total credits by adding the amounts from the previous three sections.

- Determine if you have overpaid your taxes by subtracting the total tax from your credits.

- Specify the amount you wish to donate to the Indiana Nongame Wildlife Fund, if any.

- Calculate your refund by subtracting any donations from the overpayment.

- If you owe taxes, indicate the amount owed based on the calculations made earlier.

- Finally, review all entries for accuracy before saving changes, downloading, printing, or sharing the form as needed.

Complete your It40ez Form online today for an efficient tax filing experience.

The Form 1040EZ has been replaced by a simplified version of the Form 1040. This new form allows taxpayers to report their income and claim tax benefits more efficiently. If you need assistance with this transition, uslegalforms can guide you through the process of using the updated Form 1040.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.