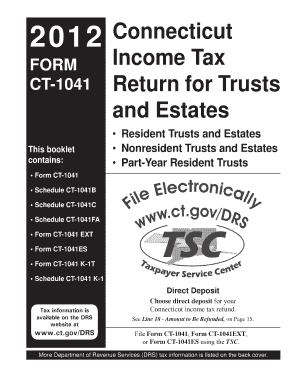

Get 2012 Form 1041 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Form 1041 Instructions online

This guide provides you with detailed, step-by-step instructions on how to fill out the 2012 Form 1041 Instructions online. It is designed to assist users of all experience levels in ensuring the process is straightforward and efficient.

Follow the steps to successfully complete the 2012 Form 1041 Instructions.

- Click the ‘Get Form’ button to acquire the form and open it in your editor.

- Review the general information section to understand who needs to file the form, including the definition of various types of trusts and estates.

- Fill out the federal employer identification number (FEIN) if it has been issued, entering it clearly in the designated space.

- Enter the name and address of the fiduciary in the appropriate sections at the top of the form.

- Complete the sections outlining the type of return, noting whether it’s a final or amended return as applicable.

- Calculate Connecticut taxable income by entering the total federal taxable income and adjusting it as necessary with any fiduciary adjustments.

- Proceed to calculate the Connecticut income tax by multiplying the taxable income by the applicable tax rate.

- Include any credits for income taxes paid to qualifying jurisdictions by completing the appropriate worksheet, and attach relevant documentation.

- After filling out all sections with accurate information, review your entries to ensure no mistakes are present.

- Once satisfied with the completed form, you can choose to save your changes, download the form, print it, or share it accordingly.

Complete your forms online today to ensure timely and accurate submissions.

Income taxed within a trust generally includes all income generated by the trust's assets, such as interest, dividends, and capital gains. According to the 2012 Form 1041 Instructions, this income is subject to taxation at the trust's tax rates, which can be higher than individual rates. It's crucial to understand the implications of income distribution to beneficiaries as it can affect overall tax liability. For detailed guidance, consider using US Legal Forms to navigate these complexities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.