Loading

Get Ct Form 8822c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct Form 8822c online

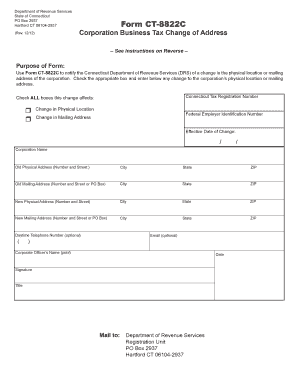

This guide provides detailed instructions on how to complete the Ct Form 8822c online to notify the Connecticut Department of Revenue Services of a change in your corporation's address. Whether you are a seasoned professional or a first-time user, this guide will walk you through each step with clear and accessible information.

Follow the steps to fill out the Ct Form 8822c online effectively.

- Press the ‘Get Form’ button to access the form and open it in an online editing tool.

- Begin by entering the corporation’s Connecticut Tax Registration Number and Federal Employer Identification Number in the designated fields. Ensure that these numbers are accurate to avoid processing delays.

- Next, indicate the reason for the address change by checking the appropriate box — either ‘Change in Physical Location’ or ‘Change in Mailing Address’.

- Provide the old physical address by filling in the Number and Street, City, State, and ZIP code fields. Repeat this process for the old mailing address.

- Now, input the new physical address in the same manner as the old address. Make sure to fill in all required fields accurately to reflect the new location.

- If applicable, fill in the new mailing address following the same format as the previous sections. Double-check for any typos to ensure correct delivery.

- Enter the effective date of the change in the provided format. This date indicates when the new address will take effect.

- Optionally, include a daytime telephone number and email. This information can help the Department of Revenue Services contact you if needed.

- As the final step, the corporate officer must print their name, sign, add their title, and date the form to validate the submission.

- Once all sections are completed, save any changes. You can then download, print, or share the form as required.

Complete your forms online today for a faster and more efficient submission process.

To fill out an income tax return form, start by gathering all necessary financial documents, including W-2s and 1099s. Next, accurately report your income, deductions, and credits on the form. If you find the process overwhelming, you can utilize platforms like US Legal Forms to simplify the steps and ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.