Get Ct792 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct792 Form online

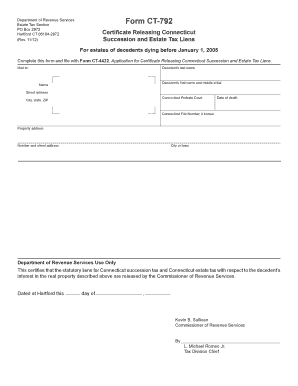

Filling out the Ct792 form is essential for releasing Connecticut succession and estate tax liens for estates of decedents who passed away before January 1, 2005. This guide provides clear, step-by-step instructions on completing the form online, ensuring all required information is accurately entered.

Follow the steps to fill out the Ct792 form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the decedent’s last name in the designated field.

- Input the decedent’s first name and middle initial as required.

- Provide the decedent’s date of death in the appropriate section.

- If known, fill in the Connecticut file number related to the probate case.

- Enter the property address, including the number and street address, city or town.

- Complete the form by ensuring all information is accurate and appropriately entered.

- Once all fields are filled, options will be available for saving changes, downloading, printing, or sharing the form.

Complete your documents online for a smoother submission process.

In Connecticut, there is no inheritance tax, so you can inherit any amount from your parents without facing tax liabilities. This policy simplifies the inheritance process significantly for many families. When completing the Ct792 Form, it's beneficial to note that while inheritance tax is absent, estate taxes may still apply. Engaging with platforms like uslegalforms can provide valuable insights into managing these forms correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.