Loading

Get Drs Form Ct 941 Hhe 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Drs Form Ct 941 Hhe 2015 online

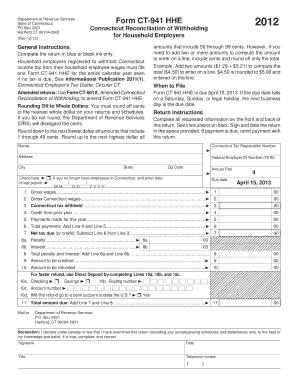

This guide provides clear and detailed instructions for completing the Drs Form Ct 941 Hhe 2015 online. Understanding the components of the form will help ensure accurate filing for household tax withholding.

Follow the steps to effectively complete the form.

- Press the ‘Get Form’ button to retrieve the form and save it to your device for editing.

- Begin by entering your Connecticut tax registration number, name, and address in the designated fields.

- Input your federal employer identification number (FEIN), and check the box next to ‘Annual Filer’ if applicable.

- Complete Lines 1 through 10 with accurate wage and tax information, following the guidelines provided for each line.

- Ensure you include the gross wages and Connecticut tax withheld on Lines 1 and 3, respectively.

- Calculate total payments made for the year on Line 5 and add Lines 4 and 5 on Line 6.

- Subtract Line 6 from Line 3 on Line 7 to determine net tax due or credit.

- Complete Lines 8a and 8b for any penalties and interest that may apply.

- Enter any amounts you wish to credit or have refunded on Lines 9 and 10 accordingly.

- If opting for direct deposit, fill out Lines 10a, 10b, and 10c with the relevant bank information.

- Summarize your total amount due on Line 11, including any penalties or interest.

- Review all entries for accuracy, sign and date the form, then save your changes, download, print, or share the completed form as needed.

Complete your Drs Form Ct 941 Hhe 2015 online to ensure efficient processing and compliance.

To obtain a CT tax form, you can visit the Connecticut Department of Revenue Services website for downloadable forms. Alternatively, the US Legal Forms platform offers the Drs Form Ct 9, making it convenient for you to access and fill out the necessary information. This streamlines the process, ensuring you have the right form when you need it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.