Loading

Get 2013 Ct 1096 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Ct 1096 Fillable Form online

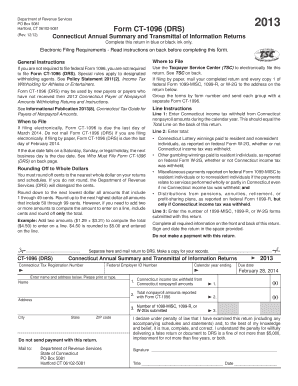

Filling out the 2013 Ct 1096 Fillable Form online can streamline your tax reporting process. This guide provides a clear overview of the form's components and step-by-step instructions to help you complete it efficiently.

Follow the steps to fill out the 2013 Ct 1096 form online:

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

- Complete the header section by entering your Connecticut Tax Registration Number and Federal Employer ID Number where indicated.

- Fill in your name, address, city, state, and ZIP code in the designated fields, making sure to print or type clearly.

- Enter the calendar year ending and the due date in the specified areas.

- On Line 1, input the total Connecticut income tax withheld from nonpayroll amounts for the calendar year.

- For Line 2, enter the total of nonpayroll amounts reported, including Connecticut Lottery winnings, other gambling winnings, and miscellaneous payments.

- On Line 3, submit the total number of Forms 1099-MISC, 1099-R, or W-2Gs that you are submitting with this return.

- Ensure you have signed and dated the return in the space provided. This certification confirms the accuracy of the information you have reported.

- Once you have reviewed the completed form for any errors, you can save changes, download it for your records, or print it for submission.

Take control of your tax reporting by completing the 2013 Ct 1096 Fillable Form online today.

You can obtain a scannable 1096 form from various online sources, but ensure it meets IRS standards. The 2013 Ct 1096 Fillable Form available on our USLegalForms platform is designed for easy printing and scanning. This ensures your submissions are processed quickly and accurately. Explore our offerings for reliable options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.