Loading

Get Ct 1041 Extension Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 1041 Extension Form online

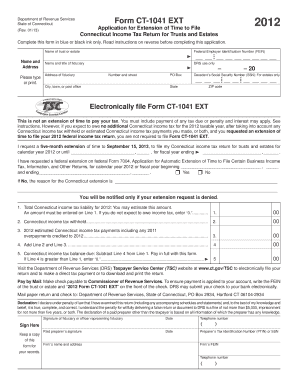

This guide provides clear, step-by-step instructions for completing the Ct 1041 Extension Form online. Designed for users with varying levels of legal experience, it ensures that you understand every component needed for a successful application.

Follow the steps to accurately complete the Ct 1041 Extension Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the form by entering the name of the trust or estate in the designated field. Ensure accuracy as this information is crucial for identification purposes.

- Enter the Federal Employer Identification Number (FEIN). It is mandatory to have an FEIN; do not write 'applied for' as the Department of Revenue Services will require a valid FEIN before processing.

- Provide the name and title of the fiduciary responsible for managing the trust or estate. This section should be clear to avoid any confusion during processing.

- Fill in the fiduciary’s address, including number and street, city, town, or post office, and ZIP code.

- If applicable, enter the decedent’s Social Security Number (SSN). This is only required for estates.

- Indicate the requested extension date. If applying for a fiscal year extension, specify the beginning and ending dates.

- Complete the total Connecticut income tax liability for the year. This is an estimate; you may enter '0' if no tax is owed.

- Fill out Connecticut income tax withheld and estimated Connecticut income tax payments. Add these amounts to determine the total tax paid.

- Calculate the Connecticut income tax balance due by subtracting the total tax payments from the total liability.

- Before submission, review the form to ensure all information is accurate and complete.

- Sign and date the form. If a paid preparer is involved, they must also provide their signature and necessary identification number.

- Once completed, save, download, print, or share the form as needed for your records or submission.

Complete your forms online today to ensure timely processing and compliance.

To electronically file a tax extension, you can use the CT 1041 Extension Form available on the Connecticut Department of Revenue Services website. The process is straightforward: fill out the required details, review them, and submit the form online. Additionally, platforms like USLegalForms provide resources and guidance to help you navigate the filing process smoothly, ensuring you meet all deadlines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.