Get Ct1040ext Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct1040ext Form online

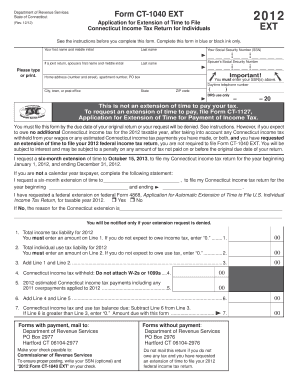

Filling out the Ct1040ext Form online can streamline your tax extension process, ensuring you meet the deadlines set by the State of Connecticut. This guide will provide step-by-step instructions for completing the form accurately and efficiently.

Follow the steps to complete your Ct1040ext Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your first name, middle initial, and last name in the appropriate fields. Ensure that you provide accurate information as it appears on your identification documents.

- Provide your home address, including any apartment number or PO box, day-time telephone number, city or town, state, and ZIP code.

- Indicate whether you have requested a federal extension by marking 'Yes' or 'No'. If you selected 'No', provide a reason for your Connecticut extension request.

- Enter your total income tax liability for the year in Line 1. If you expect to owe no tax, write '0'.

- Add Lines 1 and 2 to get the total tax liability on Line 3.

- Calculate the balance due by subtracting Line 6 from Line 3 on Line 7. If applicable, write '0' if you owe no tax.

- Review the entire form for completeness. Save your changes, and you may have options to download, print, or share your completed form as needed.

Complete your Ct1040ext Form online today to ensure you file your tax extension before the deadline.

Line 4 on the form 4868 is crucial as it pertains to the amount of tax you expect to owe. You should enter your total tax liability, which can be estimated using your previous year’s tax return or current year projections. Accurate information here is essential to avoid complications, so utilize the Ct1040ext Form wisely. If you are unsure, US Legal Forms can provide valuable support to help you fill out the form correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.