Get Employee's Withholding Certificate For Pensions And ... - Arkansas - State Ar

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee's Withholding Certificate for Pensions and Annuity Payments - Arkansas online

Completing the Employee's Withholding Certificate for Pensions and Annuity Payments in Arkansas is crucial for managing your tax obligations on pension distributions. This guide provides a clear, step-by-step approach to filling out this form online to ensure accurate tax withholding.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to download and access the Employee's Withholding Certificate for Pensions and Annuity Payments.

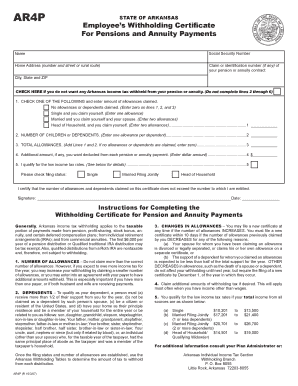

- Begin by entering your personal information in the top section of the form. This includes your name, Social Security number, home address, and any claim or identification number related to your pension or annuity contract.

- In the next section, indicate whether you wish to have Arkansas income tax withheld from your payments. If you do not want any tax withheld, check the provided box to bypass filling out lines 2 through 6.

- Proceed to check the appropriate box under the allowances section. You will choose one of the options based on your filing status: 'No allowances or dependents claimed', 'Single', 'Married', or 'Head of Household'. Enter the corresponding number of allowances claimed.

- If you have children or other dependents, indicate the number by filling out line 2, then calculate your total allowances by adding the numbers from lines 1 and 2 on line 3.

- If desired, specify any additional amount you wish to be deducted from each pension or annuity payment on line 4. This step is optional and should reflect your financial situation.

- Indicate your filing status again by checking the appropriate box (Single, Married Filing Jointly, Head of Household) as per your situation.

- Finally, certify the accuracy of the information provided by signing the form and entering the date. Ensure that all fields are filled out correctly before submitting the form to your payer.

- After completing the form, you have the option to save changes, download, print or share the completed certificate as necessary.

Start completing the Employee's Withholding Certificate for Pensions and Annuity Payments online today to ensure accurate tax management.

To determine if you have state withholding from your pension, review your pension payment statements for any deductions. If your payments show a deduction for state income tax, it indicates that withholding is in effect. Additionally, using the Employee's Withholding Certificate For Pensions And ... - Arkansas - State Ar can clarify your withholding status and preferences. If you're unsure, consulting with a tax professional or utilizing the resources at uslegalforms can provide further assistance in understanding your withholding situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.