Loading

Get 2019 Ar941m

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2019 Ar941m online

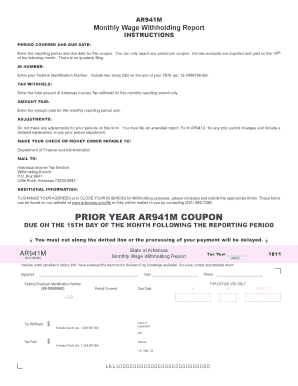

Filling out the 2019 Ar941m is essential for properly reporting wage withholding for the state of Arkansas. This guide will help you navigate the form's components and provide step-by-step instructions for completing it online.

Follow the steps to successfully complete the 2019 Ar941m online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the reporting period and due date for the coupon. Only one reporting period can be submitted per coupon. New accounts need to be reported and submitted by the 15th of the following month.

- Input your Federal Identification Number. Ensure to include two zeros (00) at the end of your FEIN, e.g., 12-3456789-00.

- Enter the total amount of Arkansas Income Tax withheld for the specified monthly reporting period.

- Fill in the amount paid for the same monthly reporting period.

- Note that you should not make adjustments for prior periods on this form. Any prior period changes require filing an amended report using Form AR941X, which must include a detailed explanation.

- Make your check or money order payable to the Department of Finance and Administration.

- Mail your completed form to the Individual Income Tax Section, Withholding Branch, at P.O. Box 9941, Little Rock, Arkansas 72203-9941.

- If you need to change your address or close your business for withholding purposes, complete the appropriate forms available online or by calling (501) 682-7290.

- Once you have filled out all required fields, save your changes, download, print, or share the completed form as needed.

Complete your 2019 Ar941m online today!

The AR4EC form is used for reporting employee wages and withholding for Arkansas state taxes, while the AR4ECSP serves a similar purpose but specifically targets school districts. Understanding these differences is crucial for compliance with local regulations, especially when dealing with the 2019 Ar941m filings. For tailored solutions and easy access to these forms, consider using the USLegalForms platform.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.