Loading

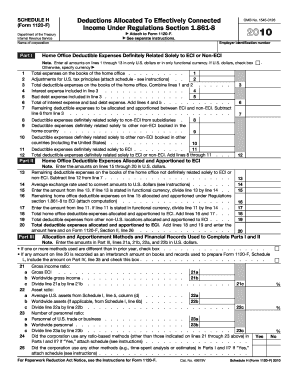

Get 2010 Form 1120-f (schedule H). Deductions Allocated To Effectively Connected Income Under

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form 1120-F (Schedule H). Deductions Allocated To Effectively Connected Income Under online

This guide provides detailed instructions for completing the 2010 Form 1120-F (Schedule H), which addresses deductions allocated to effectively connected income. Designed for a broad audience, this comprehensive resource will help users accurately navigate and fill out this important tax document.

Follow the steps to effectively complete the form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Provide your corporation's name in the designated field at the top of the form. Be sure to include your employer identification number (EIN) as required.

- Complete Part I, which includes listing deductions allocated to effectively connected income under regulations section 1.861-8. Fill in the total expenses on the books of the home office on line 1.

- On line 2, enter any adjustments for U.S. tax principles and attach a schedule if required. Then, combine lines 1 and 2 to determine the total deductible expenses on line 3.

- Report interest expense and bad debt expense on lines 4 and 5, respectively, and add these amounts to determine the total of these expenses on line 6.

- Allocate remaining deductible expenses between effectively connected income (ECI) and non-ECI as per instructions in the form.

- In Part II, complete the calculations for home office deductible expenses that relate solely to ECI. Deduct any expenses that do not qualify.

- Move on to Part III, where you must detail the allocation and apportionment methods used. Indicate if you used ratio-based methods and complete the associated lines.

- Review and verify all entries for compliance with U.S. tax principles. Ensure that amounts reported in Part IV reflect accurate calculations.

- Finally, save your changes, download, print, or share the form as needed. Ensure that you keep a copy for your records.

Complete your 2010 Form 1120-F (Schedule H) online with confidence.

The purpose of the Schedule M-1 is to reconcile the entity's accounting income (book income) with its taxable income. Because tax law is generally different from book reporting requirements, book income can differ from taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.