Get Irs E-file Signature Authorization Practitioner Pin Method ... - Irs.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS E-file Signature Authorization Practitioner PIN Method

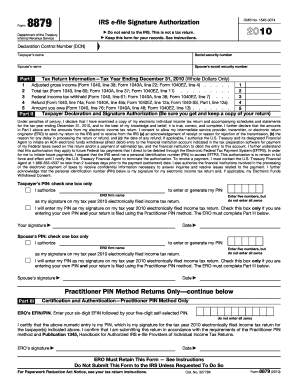

The IRS E-file Signature Authorization Practitioner PIN Method, Form 8879, is a crucial document for users filing their tax returns electronically. This guide provides clear and detailed instructions on how to accurately complete the form, ensuring smooth e-filing.

Follow the steps to complete the IRS E-file Signature Authorization Practitioner PIN Method

- Press the 'Get Form' button to obtain the IRS Form 8879 and access it on your preferred device.

- Begin by entering the taxpayer's name and social security number at the top of the form. If applicable, include the spouse's name and social security number as well.

- Proceed to Part I of the form, where you will input relevant tax return information for the tax year ending December 31. This includes adjusted gross income, total tax, federal income tax withheld, refund amount, and any amount owed. Ensure that the figures are whole dollars.

- Move to Part II, where you will make the taxpayer declaration. The taxpayer must declare the accuracy of their tax return and consent for the electronic return originator (ERO) to submit the return to the IRS. The taxpayer will select whether the ERO will enter or generate their Personal Identification Number (PIN) or if they will enter their own.

- For the PIN authorization, the taxpayer must enter five numbers in the provided field, ensuring that not all are zeros. They should also date and sign this part of the form.

- If utilizing the Practitioner PIN method, the ERO must fill in Part III with their six-digit EFIN followed by their five-digit self-selected PIN. They will certify that this represents their electronic signature.

- After completing these steps, provide the finalized Form 8879 to the taxpayer for their review and completion. Once the form is signed, the ERO must retain it for their records.

- Once all information is confirmed, the form is not to be sent to the IRS. Users can save changes, download, print, or share the form as needed for their records.

Start completing your IRS E-file Signature Authorization Practitioner PIN Method online today to ensure a smooth e-filing experience.

The 5-digit signature PIN for the IRS is a unique code used to authenticate and authorize electronic signatures on tax returns. This PIN helps ensure that the person filing the return has the right to do so. If you utilize the IRS E-file Signature Authorization Practitioner PIN Method ... - IRS, you will receive a specific PIN that you can use each tax season. It's important to keep this PIN confidential to protect your tax information.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.