Loading

Get Irs Form 8329

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 8329 online

Filling out the Irs Form 8329 online can be straightforward if you follow the right steps. This form is essential for lenders who need to report information regarding the issuance of mortgage credit certificates.

Follow the steps to complete the Irs Form 8329 online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

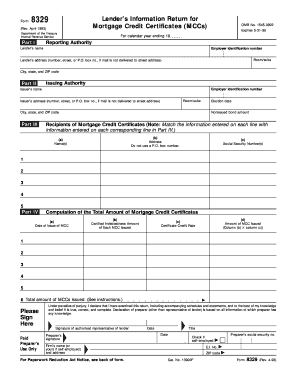

- In Part I, provide the lender’s name, employer identification number, address, city, state, and ZIP code. Ensure all information is accurately filled to reflect the lender’s identity.

- Move to Part II and enter the issuing authority’s name, employer identification number, address, election date, city, state, and ZIP code. Make sure the information corresponds to the lender's usage of mortgage credit certificates.

- In Part III, list the recipients of mortgage credit certificates. Fill in columns for the name(s), address (do not use a P.O. box), and social security number(s) corresponding to each recipient.

- In Part IV, compute the total amount of mortgage credit certificates. Input the date of issue, certified indebtedness amount for each MCC, and the certificate credit rate. Multiply the amounts and summarize the total on line 6.

- Ensure your information from Parts III and IV matches correctly. If you need to report on more than five certificates, prepare an attached document in the same format.

- Sign the form where indicated, ensuring that it is signed by an authorized representative of the lender and, if applicable, by a paid preparer.

- Finally, save any changes you made, download a copy of the completed form, print the document for your records, or share it with relevant parties as needed.

Start filling out your Irs Form 8329 online today to ensure timely and accurate reporting.

In some cases, you can pick up IRS forms at the post office, but availability may vary by location. Not all post offices carry IRS tax forms, so it’s best to call ahead or check their website. For a more reliable option, consider accessing IRS Form 8329 online, where you can download and print it at your convenience. This method ensures you have the most up-to-date version of the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.