Get 8038gc Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8038gc Form online

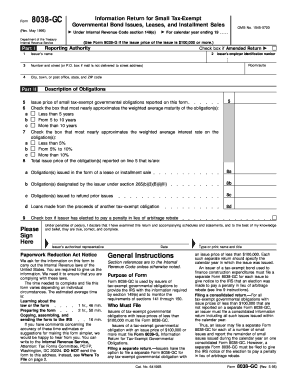

Filling out the 8038gc Form is an essential task for issuers of tax-exempt governmental obligations. This guide provides clear, step-by-step instructions for completing the form online, ensuring that users can easily navigate each section and submit their information accurately.

Follow the steps to complete the 8038gc Form online.

- Press the ‘Get Form’ button to access the 8038gc Form online and open it in your preferred editing tool.

- Enter the issuer’s name at the top of Part I. This should be the name of the entity issuing the obligations.

- Provide the issuer's complete address, including number and street, city, state, and ZIP code.

- Identify the reporting authority by filling out the information required in Part I, including the applicable employer identification number (EIN). If you do not have an EIN, note that you have applied for one.

- In Part II, describe the obligations being reported. State the issue price of the obligations, ensuring that it reflects the principal amount due without interest.

- Indicate the weighted average maturity of the obligation(s) by selecting the appropriate box for less than 5 years, from 5 to 10 years, or more than 10 years.

- Select the appropriate box for the weighted average interest rate that corresponds to the obligation(s) reported.

- For line 8, provide the total issue price related to obligations described under lines 8a through 8d, making sure to include any applicable designations.

- Lastly, sign and date the form in the designated area, confirming that the information provided is true and complete.

- Once you have filled out the entire form, save your changes and download the completed document. You can also print or share it as needed.

Start filling out the 8038gc Form online now to ensure compliance with government regulations.

Form 8332 is a document that allows a custodial parent to release their claim to a child's tax exemption to the non-custodial parent. This form is crucial for parents who share custody, as it helps clarify which parent can claim the child on their tax return. By using Form 8332, you can ensure that both parents understand their tax responsibilities and benefits. If you need assistance with this process, consider using US Legal Forms for easy access to necessary documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.