Loading

Get Form B22a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form B22a online

Filling out the Form B22a is an essential step for individuals seeking relief under Chapter 7 bankruptcy. This guide will provide a clear and user-friendly approach to completing the form online, focusing on each section and field to ensure accurate submission.

Follow the steps to complete the Form B22a online

- Press the ‘Get Form’ button to access the Form B22a and open it in your preferred online viewer.

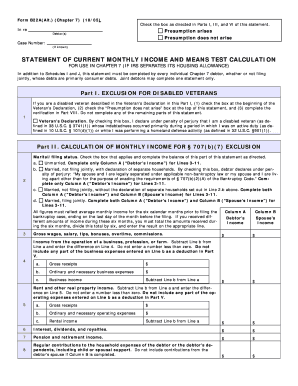

- Begin by reviewing Part I, where you will check the appropriate boxes regarding your status as a disabled veteran, if applicable. Be mindful to indicate whether the presumption arises based on your input.

- In Part II, state your marital or filing status and fill in the corresponding income information for yourself and your spouse, ensuring to include average monthly income from various sources.

- Continue to Part III to calculate the annualized current monthly income. Here, you will compare your income against the median family income for your state, checking the relevant box based on the comparison.

- In Part IV, detail your current monthly income and make any necessary adjustments based on your marital status.

- Next, move to Part V to specify the deductions allowed under IRS standards, providing detailed figures on living expenses, local standards, and any additional necessary costs.

- Proceed to Part VI to assess the presumption under § 707(b)(2) by entering the disposable income calculations and determining if the presumption arises.

- In Part VII, list any additional expense claims that were not previously detailed in the form that may qualify for deductions.

- Complete Part VIII by verifying that all provided information is true and accurate, then sign where indicated by you and any joint debtor.

- Once you have filled in all relevant sections, take a moment to review your entries, and then save your changes. You may download, print, or share the completed form as needed.

Begin completing the Form B22a online today to ensure a smooth bankruptcy process.

To fill out an income and expenditure form, first, collect information about all your income sources, including salaries and benefits. Next, list your monthly expenses, ensuring you include all necessary payments. Form B22a simplifies this process by providing a structured format to capture your financial details accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.