Loading

Get Pittsburgh Eit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pittsburgh Eit Form online

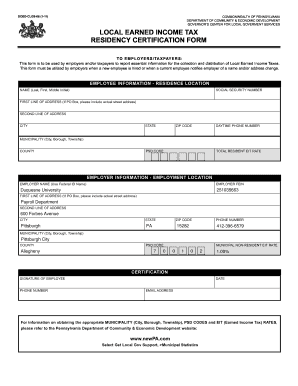

Filling out the Pittsburgh Earned Income Tax Form is a crucial process for employers and taxpayers to report essential information. This guide will provide clear instructions to help users navigate and complete the form effectively online.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin with the employee information section. Enter the employee's name in the format of Last, First, and Middle Initial. Make sure all details are accurate and up to date.

- Input the employee's social security number. This information is required for tax processing and should be kept confidential.

- Fill in the first line of the employee's address. If using a P.O. Box, include the actual street address to ensure accurate tax records.

- Complete the second line of the address if necessary, followed by the city, state, and zip code fields.

- Provide the employee's daytime phone number for contact purposes.

- Specify the municipality where the employee resides, including the borough or township.

- Enter the county name and the associated PSD code, which is necessary for tax collection.

- Indicate the total resident EIT rate relevant to the municipality.

- Now, move to the employer information section. Start by entering the employer's name as it appears on the Federal ID.

- Fill in the Employer FEIN (Federal Employer Identification Number). This is essential for tax identification.

- Complete the employer's address fields: first and second lines, city, state, zip code, and the phone number.

- Specify the municipality where the employer is located, followed by the county name and the PSD code.

- Input the municipal non-resident EIT rate where applicable.

- Finally, in the certification section, the employee must sign and date the form, including their phone number and email address.

- Once all information has been entered and reviewed, remember to save changes, download the form, and/or print or share it as needed.

Complete your Pittsburgh Earned Income Tax Form online today to ensure accurate tax reporting.

Filing a Pennsylvania tax form online is straightforward. You need to gather your tax documents and access the online filing system provided by the Pennsylvania Department of Revenue. Our platform offers helpful resources and the Pittsburgh EIT Form, streamlining the filing process for you. By filing online, you can receive immediate confirmation of your submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.