Loading

Get Pdf Format - Model City Tax Code

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PDF Format - Model City Tax Code online

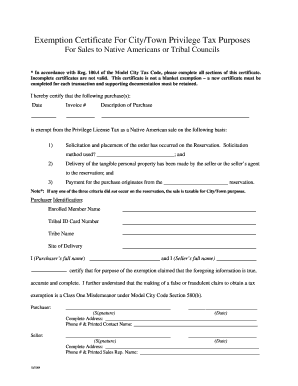

Filling out the PDF Format - Model City Tax Code accurately is essential for claiming tax exemptions related to sales to Native Americans or Tribal Councils. This guide offers a step-by-step process to assist you in completing the form online, ensuring you meet all necessary requirements.

Follow the steps to complete the exemption certificate correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the date of the purchase in the specified field. Ensure you provide the correct date for accurate documentation.

- In the invoice number field, input the invoice number associated with the transaction to maintain a clear record of the purchase.

- Describe the purchase in the description field, providing as much detail as necessary to identify the tangible personal property being acquired.

- You must confirm the basis for the tax exemption by checking that the solicitation and placement of the order occurred on the reservation. Specify the solicitation method used in the space provided.

- Indicate that the delivery of the property has been made to the reservation, as this is a vital criterion for the exemption. Ensure both you and the seller acknowledge this requirement.

- Fill in the information for payment origin, ensuring that the payment originates from the reservation to meet the exemption criteria.

- Complete the Purchaser Identification section with your enrolled member name, tribal ID card number, tribe name, and site of delivery for verification purposes.

- Sign and date the certificate as the purchaser, ensuring your full name is clearly printed. This affirms that the information provided is accurate.

- Once all fields are filled out, review the document to ensure all information is accurate and complete. After confirming accuracy, you can save changes, download, print, or share the completed form.

Take action now by filling out your exemption certificate online to ensure compliance and secure your tax exemption.

The minimum combined 2023 sales tax rate for Phoenix, Arizona is 8.6%. This is the total of state, county and city sales tax rates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.