Get Ftb3519

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb3519 online

The Ftb3519 is an essential form for individuals seeking an automatic extension for filing their tax returns. This guide will provide a clear, step-by-step approach to filling out this form online, ensuring you meet all necessary requirements and deadlines.

Follow the steps to successfully complete your Ftb3519 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In the Name and Address section, enter your full name(s), your current home address, and your social security number(s) accurately. Ensure that if you lease a private mailbox, you include the box number in the field labeled 'PMB no.' in the address area.

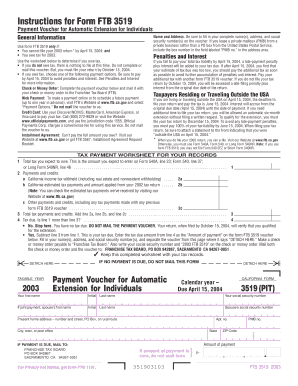

- For General Information, read through the details. You should use form FTB 3519 if you cannot file your 2003 return by April 15, 2004, and if you owe tax for that year. Use the provided worksheet to verify if you owe any tax.

- Determine your payment option based on your tax situation. If you owe tax, choose from the options provided: Check or Money Order, Web Payment, Credit Card, or Installment Agreement. Pay by April 15, 2004, to avoid any penalties.

- Fill out the Tax Payment Worksheet located within the form. Calculate the total tax you expect to owe and line by line, assess your payments and credits from previous years or withholdings.

- Identify if you have tax due by comparing total anticipated tax with total payments and credits. If there is a positive balance (meaning you do owe), proceed to the next step.

- If your worksheet indicates you owe tax, note this amount in the 'Amount of payment' on the voucher section of the form.

- Complete the payment voucher section by filling in your name(s), address, and social security number(s). Detach the voucher from the worksheet.

- Make your payment payable to 'Franchise Tax Board' and ensure to write your social security number along with '2003 FTB 3519' on the check or money order.

- Mail the voucher along with the payment to the specified address: Franchise Tax Board, PO Box 942867, Sacramento CA 94267-0051. After you have submitted the form, review all details for accuracy.

Take the first step and fill out your Ftb3519 online today to ensure a smooth filing process.

A reasonable cause for FTB penalty abatement involves situations where taxpayers can demonstrate that they were unable to meet their tax obligations due to circumstances beyond their control. Examples include natural disasters, serious illness, or other significant life events that hindered timely filing or payment. If you believe you qualify for an abatement, presenting detailed documentation is essential. Using resources like uslegalforms can guide you through the process of applying for penalty relief effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.