Get Nc Cd 419

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nc Cd 419 online

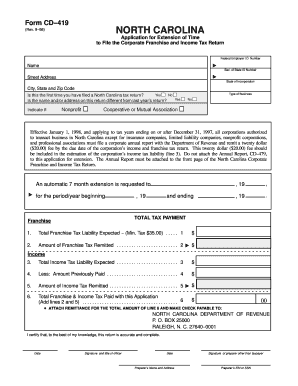

This guide provides clear instructions for completing the Nc Cd 419, an application for extension of time to file the corporate franchise and income tax return in North Carolina. Whether you have prior experience with tax forms or not, this comprehensive guide will assist you in navigating the online filing process with ease.

Follow the steps to complete the Nc Cd 419 online.

- Press the 'Get Form' button to access the Nc Cd 419 and open it in your chosen online editor.

- Begin by entering your Federal Employer I.D. Number, which is essential for identification purposes.

- Provide your corporation's official name and street address. Ensure accuracy as these details must match official records.

- Fill in your Sec. of State ID Number and state of incorporation. This is crucial for verifying your entity's registration.

- Indicate your city, state, and zip code to complete your address information.

- Answer the question about whether this is your first time filing a North Carolina tax return by selecting 'Yes' or 'No.'

- If there are any changes to your name or address from last year's return, indicate this by selecting 'Yes' or 'No.'

- Select the type of business you operate, such as nonprofit or cooperative, to classify your corporation.

- Specify the period for which you are requesting the extension by entering the starting and ending dates.

- Calculate and input your expected total franchise tax liability on line 1, ensuring it meets the minimum of $35.00.

- Record the amount of franchise tax you will remit on line 2. This is necessary for your payment tracking.

- Next, enter your expected total income tax liability on line 3 and any previously paid amounts on line 4.

- Complete line 5 with the amount of income tax you are remitting with this application.

- Sum the amounts from lines 2 and 5 on line 6 to determine the total tax you are submitting.

- Attach your remittance for the total amount on line 6 and make the check payable to the North Carolina Department of Revenue.

- Sign and date the form, ensuring the accuracy of the information provided. If someone else prepared the form, include their information and signature.

- Finally, save any changes made to the document. Download, print, or share your completed Nc Cd 419 as needed.

Complete your Nc Cd 419 online today to ensure timely processing!

You can pick up NC state tax forms at various locations, including local tax offices and public libraries. Additionally, the North Carolina Department of Revenue offers these forms online, which is a convenient option. For a comprehensive selection of tax-related documents, including NC CD 419, visit US Legal Forms, where you can easily access and download the necessary forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.