Get Wisconsin Form 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wisconsin Form 2 online

Filling out the Wisconsin Form 2 online is a straightforward process designed to make the reporting for estates and trusts easier for users. This guide will provide you with step-by-step instructions to successfully complete each section of the form.

Follow the steps to fill out the Wisconsin Form 2 online.

- Click the ‘Get Form’ button to access the form and launch it in the online editor.

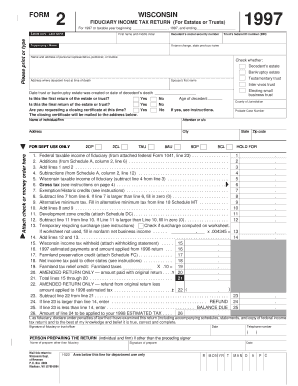

- Begin by entering the name of the estate or trust in the appropriate fields. For estates, provide the last name, first name, and middle initial of the decedent. For trusts, enter the trust's name.

- Provide the decedent's social security number and the trust's federal ID number (EIN) if applicable. If there has been a name change, state the previous name.

- Fill in the name and address of the personal representative, petitioner, or trustee responsible for the estate or trust.

- Indicate whether the form pertains to a decedent's estate, bankruptcy estate, testamentary trust, inter vivos trust, or electing small business trust by checking the appropriate box.

- Include the address where the decedent lived at the time of death.

- Provide the date the trust or bankruptcy estate was created, or the date of the decedent’s death. Also indicate if this is the first return of the estate or trust.

- State the age of the decedent and confirm if this is the final return of the estate or trust.

- If requesting a closing certificate, check the appropriate box and provide the name and address where the closing certificate should be sent.

- Complete the income tax return section with details on federal taxable income, additions, subtractions, and any applicable modifications as per the instructions.

- Sign and date the form at the designated area to confirm accuracy and completeness.

- Finally, users can choose to save changes, download, print, or share the completed form as necessary.

Start filling out your Wisconsin Form 2 online today!

The Wisconsin Form 2 is a tax form used by residents to report their income and calculate their state tax liability. This form is essential for individuals who need to file their state taxes accurately and efficiently. By using the Wisconsin Form 2, you can ensure you meet your tax obligations while maximizing your potential deductions. For convenience, you can obtain this form easily through uslegalforms, which provides a user-friendly platform for all your tax-related needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.