Get Guam Grt Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Guam GRT Instructions online

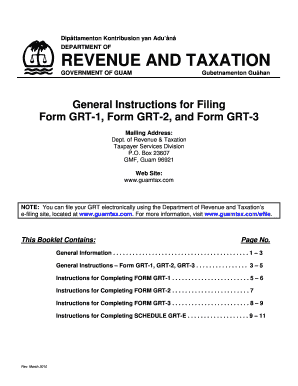

Filling out the Guam GRT forms can seem overwhelming, but this guide provides clear, step-by-step instructions to help you navigate the process online. Whether you are filing for gross receipts, liquid fuel tax, or tobacco tax, understanding these forms is essential for compliance.

Follow the steps to successfully complete the Guam GRT Instructions.

- Press the ‘Get Form’ button to access the Guam GRT form and open it in the online editor.

- Begin by entering your licensed business name in the specified field. Ensure that you do not use any DBA (doing business as) names here.

- Fill in your business's Employer Identification Number (EIN) or Social Security Number (SSN) accurately, avoiding any dashes.

- Provide your business GRT account number in the designated area. Again, do not include dashes.

- Indicate the month and year for which you are filing using the MM YYYY format, ensuring it reflects the correct tax period.

- Select whether this submission is an original return or an amended return by darkening the appropriate oval.

- Input your business address as it is officially recognized. This field is not for updating your address.

- Include a valid business telephone number for contact purposes.

- On the relevant lines, report your gross receipts or other taxable amounts. If there is no income or tax due, enter '0' in each corresponding field.

- If eligible for exemptions or deductions, fill out Schedule GRT-E and attach it to your form. Include all necessary details.

- Finally, save your completed form, and choose to download, print, or share it as required.

Complete your Guam GRT forms online today to ensure compliance and simplify your tax filing process.

Failing to file your Guam taxes can lead to penalties, interest charges, and potential legal action. The Department of Revenue and Taxation in Guam takes tax compliance seriously, which is why it is crucial to submit all necessary forms on time. If you need guidance on filing, the Guam Grt Instructions can simplify the process for you. Utilizing platforms like US Legal Forms can also provide you with the necessary resources to ensure you meet your tax obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.