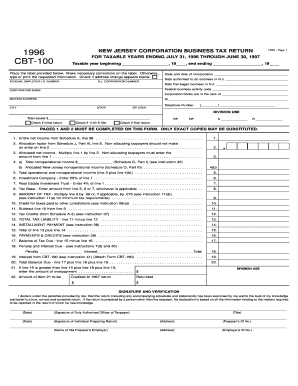

Get Form Cbt-100a - 1996 - State Of New Jersey

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CBT-100A - 1996 - State Of New Jersey online

Filling out the Form CBT-100A for the Corporation Business Tax in New Jersey can be straightforward if done methodically. This guide provides clear, step-by-step instructions to help users complete the form accurately online.

Follow the steps to fill out the Form CBT-100A effectively.

- Click ‘Get Form’ button to obtain the form and access it in the editor.

- Enter the Federal Employer Identification Number, New Jersey Corporation Number, and corporation name in the specified fields at the top of the form.

- Indicate the accounting period by filling in the tax year beginning and ending dates. Ensure that they are consistent with your financial year.

- Complete the principal business activity code based on information from your federal tax return. This code identifies the main activity of your business.

- Provide the mailing address, including city, state, and ZIP code, clearly and accurately.

- Follow the instructions to complete Schedule A, which includes the computation of entire net income. Fill in the gross receipts, costs, and relevant income items as instructed.

- Complete any applicable schedules indicated on the form based on your business classification, such as Schedules H, J, or L.

- Review the tax rate and ensure that you're applying the correct rate as per the latest eligibility criteria.

- Sign the form as required, ensuring it is signed by an authorized officer of the corporation. Include the date and title.

- Once completed, you can save changes, download, print, or share the form for your records.

Complete and submit your Form CBT-100A online to fulfill your tax obligations efficiently.

To file a senior tax freeze in New Jersey, eligible seniors must complete the necessary forms and submit them to their local tax assessor's office. This process helps protect qualifying seniors from property tax increases. The application may require supporting documents and can often be facilitated through resources like uslegalforms. They offer comprehensive guidance and the relevant forms, including those related to Form CBT-100A - 1996 - State Of New Jersey, to simplify your filing experience.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.