Get 2012 Schedule E Ohio Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Schedule E Ohio Form online

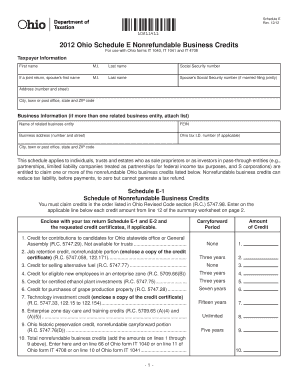

Filling out the 2012 Schedule E Ohio Form online can be a straightforward process with the right guidance. This guide provides step-by-step instructions to help you accurately complete the form and claim your nonrefundable business credits.

Follow the steps to fill out the 2012 Schedule E Ohio Form with ease.

- Press the ‘Get Form’ button to obtain the 2012 Schedule E Ohio Form and open it in your editor.

- Enter your taxpayer information in the designated fields. Include your first name, middle initial, last name, and Social Security number. If filing jointly, provide your spouse's details as well.

- Fill in your address, city, state, and ZIP code in the corresponding fields. Ensure that this information is up to date to avoid any processing issues.

- For business information, input the name of the related business entity, its Federal Employer Identification Number (FEIN), and the business address. Add the Ohio tax I.D. number if applicable.

- Move on to Schedule E-1, where you will list the nonrefundable business credits you intend to claim. Follow the order specified and enter the credit amounts based on your calculations or supporting documents.

- Complete Schedule E-2, the nonrefundable business credit summary worksheet. Provide your ownership interests and the corresponding credit amounts, ensuring all calculations meet the requirements.

- Review all entered information for accuracy. Make any necessary corrections to ensure that your form is complete and correct.

- Once you have filled out the entire form, save your changes and prepare to download, print, or share the form as required for submission.

Begin filling out your 2012 Schedule E Ohio Form online today to take advantage of available business credits!

The Ohio IT 1040 form is the state's individual income tax return, which you must file to report your income earned in Ohio. This form integrates with the 2012 Schedule E Ohio Form if you have rental income or other sources that need to be reported. Filing this form accurately helps you calculate your state tax liability and may also affect your eligibility for certain credits. Accessing the right resources can simplify this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.