Loading

Get Sbi Smart Swadhan Plus

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sbi Smart Swadhan Plus online

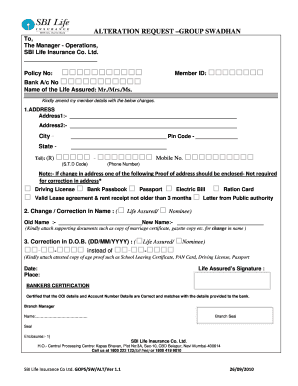

The Sbi Smart Swadhan Plus is a significant document for amending member details in the SBI Life Insurance System. This guide provides a clear and supportive walkthrough to help users fill out the form online efficiently.

Follow the steps to complete the Sbi Smart Swadhan Plus online.

- Press the ‘Get Form’ button to retrieve the form and access it for editing.

- Start by filling in your Policy Number, Member ID, and Bank Account Number in the designated fields.

- Provide the name of the Life Assured, using the format Mr./Mrs./Ms., as applicable.

- In the Address section, enter your new Address1 and Address2 if applicable. Make sure to include the city, pin code, and state accurately.

- You will need to provide your telephone number, including your STD code, and your mobile number.

- If you are changing your address, attach one of the required proof of address documents as specified in the form.

- For changes or corrections in the name, state the Old Name and New Name clearly. Ensure to include supporting documents if necessary.

- If you are correcting the Date of Birth, enter the correct date in the format DD/MM/YYYY. Attach an attested copy of the proof of age.

- Complete the form by signing it as the Life Assured and providing the date and place of signing.

- Finally, the Branch Manager must certify that the details are accurate and match with the records. There should be a place for their name and branch seal.

- Once you have entered all necessary information, save your changes. You may choose to download, print, or share the completed form as needed.

Complete your Sbi Smart Swadhan Plus document online today!

The SBI retirement smart plan is a robust option for those planning for their golden years. It offers a structured approach to saving for retirement, ensuring you have a steady income post-retirement. The plan typically includes various investment avenues, helping you grow your savings over time. If you're looking for a complementary option, consider the Sbi Smart Swadhan Plus to enhance your retirement portfolio.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.