Loading

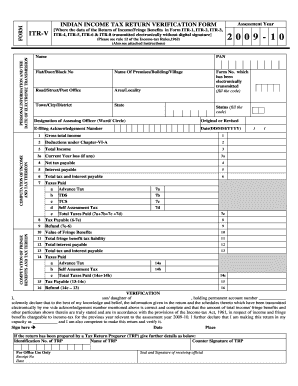

Get Indianincometaxreturnverificationform

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indian income tax return verification form online

Filling out the Indian income tax return verification form online can streamline the submission process and enhance accuracy. This guide will help you navigate each section of the form, ensuring that you are well-equipped to complete it successfully.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with personal information. Enter your name, permanent account number (PAN), address details including flat or door number, name of the premises or building, road or street, area or locality, town, city, district, and state.

- Fill in the form number which has been electronically transmitted by entering the appropriate code.

- Indicate your status by filling in the required code.

- Mention the designation of the assessing officer including the relevant ward or circle.

- Specify if the return is original or revised.

- Provide the e-filing acknowledgement number and the date of transmission in the specified format (DD/MM/YYYY).

- Input the computation of income. Include gross total income, deductions under Chapter VI A, total income, current year losses if any, net tax payable, interest payable, and total tax and interest payable.

- Detail the taxes paid. This includes advance tax, TDS, TCS, self-assessment tax, and total taxes paid. Calculate and specify the tax payable and any refund due.

- In the verification section, declare the accuracy and completeness of the information provided, backing it with your signature, date, and place of signing.

- If a tax return preparer assisted you, include their details as needed and ensure their counter signature is present.

- Finally, save your changes and download, print, or share the form as needed.

Complete and submit your documents online with confidence.

After successfully e-verifying your ITR, you should receive a confirmation email from the income tax department. This email serves as proof of your ITR verification and should be saved for your records. Next, you can track the status of your return and any refunds through the income tax portal. Utilizing services from US Legal Forms can assist you with any further documentation or questions you may have regarding your tax filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.