Loading

Get Form 104

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 104 online

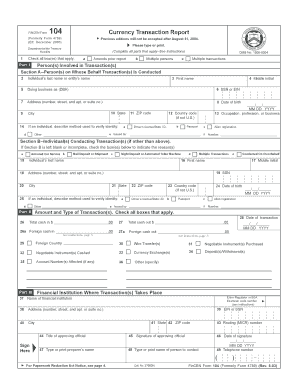

Filling out Form 104, the Currency Transaction Report, can seem daunting. This guide provides clear, step-by-step instructions tailored for users of all levels of experience, ensuring that you can complete the form accurately and efficiently online.

Follow the steps to complete the Form 104 online.

- Use the 'Get Form' button to access and open the Form 104 online for completion.

- Begin with Part I. Check all relevant boxes to indicate if this form amends a prior report, involves multiple persons, or multiple transactions.

- In Section A, provide the individual's or entity's last name, first name, and middle initial. If applicable, fill in the doing business as (DBA) name, and enter the Social Security Number (SSN) or Employer Identification Number (EIN).

- Enter the complete address including the street number, city, state, ZIP code, and if applicable, the country code. Include the date of birth in the specified format.

- Specify the individual’s occupation, profession, or business, and if required, describe the method used to verify their identity.

- Proceed to Section B if transactions are conducted by an individual other than the one listed in Section A. Complete this section similarly, providing their name, SSN, address, and date of birth.

- In Part II, report the total cash involved in the transactions, both cash in and cash out, along with the date of the transaction.

- Check all applicable transaction types from the list provided (e.g., wire transfers, negotiable instruments) and report account numbers affected, if any.

- Complete Part III by entering the financial institution's name, address, and EIN or SSN, and sign as the approving official where indicated.

- Review all information for accuracy before you save changes, download, print, or share the completed Form 104.

Take the next step to manage your financial reporting by completing your Form 104 online now.

You can file your Form 1040 either electronically or by mail. E-filing is often the preferred method due to its speed and efficiency, allowing for quicker refunds. Alternatively, you can print your completed form and mail it to the IRS. Regardless of the method you choose, make sure to keep a copy for your records and consider using US Legal Forms for added guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.