Loading

Get Form V2b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form V2b online

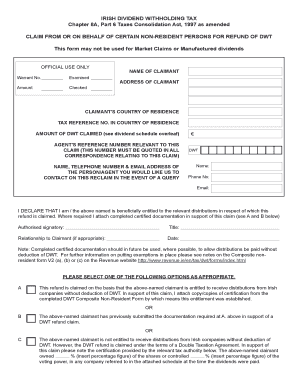

Filling out the Form V2b for claiming a refund of Dividend Withholding Tax (DWT) can seem daunting. This guide will walk you through each section of the form to ensure you complete it correctly and efficiently.

Follow the steps to successfully complete the Form V2b.

- Press the ‘Get Form’ button to access the form and open it in your editor of choice.

- Begin by entering the name and address of the claimant in the designated fields. Ensure that the information is accurate and matches official documents.

- Fill in the claimant's country of residence and their tax reference number in that country. This will help validate the claim.

- In the next field, specify the amount of DWT claimed in euros. Refer to the attached dividend schedule for accurate figures.

- Provide the agent’s reference number related to this claim, which must be quoted in all correspondence.

- Complete the contact information for the person or agent for queries regarding the claim, including their name, phone number, and email address.

- In the declaration section, state that the claimant is beneficially entitled to the relevant distributions. Attach any required certified documentation in support of the claim.

- Select the appropriate option (A, B, or C) based on the claim circumstances, and provide any necessary percentages of shares or voting power where applicable.

- Complete the schedule of dividends section, listing the companies, number of shares, dividend payment dates, and the DWT claimed for each entry.

- If the refund is claimed under a double taxation agreement, ensure that the certification section is filled out by the claimant's tax authority.

- Choose your repayment details by selecting one of the options: Electronic Funds Transfer, cheque made payable to the claimant, or cheque payable to a bank account. Provide necessary banking details for the chosen option.

- Review the completed form thoroughly for accuracy. Once satisfied, you can save changes, download, print, or share the form as needed.

Ensure your documents are correctly filled out and submit your claim for a refund of Dividend Withholding Tax online today.

Related links form

Filling out Form 8889 line 3 requires you to report contributions made to your Health Savings Account (HSA). You must include any contributions made by you or your employer during the tax year. Make sure to check the contribution limits for the year to avoid errors. For detailed guidance, the USLegalForms platform offers templates and resources that can assist you in completing Form 8889 accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.