Loading

Get R85 Form 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R85 Form 2020 online

The R85 Form 2020 allows individuals to receive interest without tax deductions, provided they meet certain eligibility criteria. This guide offers a clear, step-by-step approach to completing the form online, ensuring you provide accurate information to avoid unnecessary tax liabilities.

Follow the steps to fill out the R85 Form 2020 online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

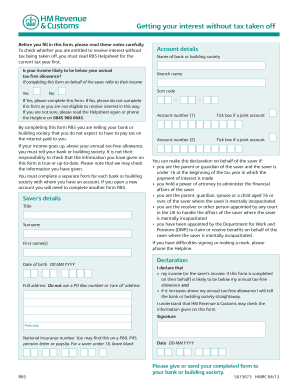

- Provide the saver’s details in the designated fields. Include their title, surname, first name(s), date of birth, and full address, ensuring not to use a PO Box number or ‘care of’ address.

- Enter the account details. Specify the name of the bank or building society, branch name, sort code, and account numbers. If applicable, tick the box indicating if the account is a joint account.

- If you are completing the form on behalf of another person, indicate your authority in the relevant section, explaining your relationship to the saver or if you hold a power of attorney.

- Complete the declaration section. Confirm that either your income or the saver’s income is likely to be below the annual tax-free allowance, and state that you will inform the bank if the income increases.

- Provide your National Insurance number and sign the form, ensuring the date is filled in correctly.

- Once all fields are correctly filled, save your changes, and download the form for your records. You may also print or share the completed form with your bank or building society.

Start completing your R85 Form 2020 online to ensure you receive your interest without unnecessary tax deductions.

You should submit a P85 form when you leave the UK to live or work abroad for more than a full tax year. This form helps HMRC adjust your tax status and can assist in reclaiming any overpaid taxes. Along with the R85 Form 2020, submitting these forms through the US Legal Forms platform can help ensure you meet all requirements efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.