Loading

Get Ct204

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct204 online

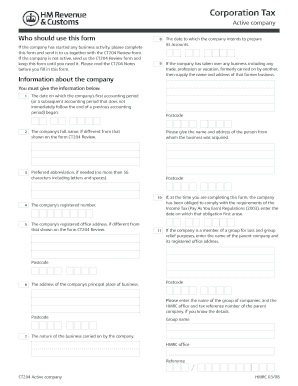

The Ct204 form is essential for active companies to report their corporation tax status. This guide provides clear, step-by-step instructions on how to accurately complete this document online, ensuring compliance with tax regulations.

Follow the steps to successfully complete the Ct204 form.

- Click the ‘Get Form’ button to obtain the Ct204 form and open it in your preferred editor.

- Enter the start date of the company's first accounting period in the designated field. This marks the beginning of your financial records.

- Provide the company's full name, especially if it differs from the name on the CT204 Review form. Ensure accuracy to avoid complications.

- Fill in the company's registered number accurately. This unique identifier is crucial for HMRC records.

- If the company's registered office address is different from what's listed on the CT204 Review form, provide that updated address here.

- Enter the principal place of business address, making sure it is the actual location where the company operates.

- Complete information about the business nature, ensuring it aligns with the company's activities for better clarity during assessment.

- List all directors' full names and home addresses. If there are more than two, provide additional information on a separate sheet.

- Designate a contact person for corporation tax affairs, including their name and a valid telephone number.

- Indicate if the company makes payments to any directors, shareholders, employees, or subcontractors by ticking the appropriate boxes.

- Attach a copy of the company's Articles of Association, if required, and mark the box indicating it is attached.

- Declare the accuracy of the information by signing the form. Ensure that the signature is not a photocopy, as this is not acceptable.

- Once all sections are completed, save changes, and consider downloading, printing, or sharing the form as needed.

Ensure your corporation tax filings are completed accurately and efficiently by following these steps to fill out the Ct204 online.

Any individual or entity that earns income in New York City may be required to file the CT204 form. This includes both residents and non-residents who meet certain income levels. Filing this form is a crucial part of maintaining compliance with New York City's tax laws. To make the process easier, USLegalForms offers resources that can guide you through filing the CT204 correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.