Get Si 1980 Number 709 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Si 1980 Number 709 Form online

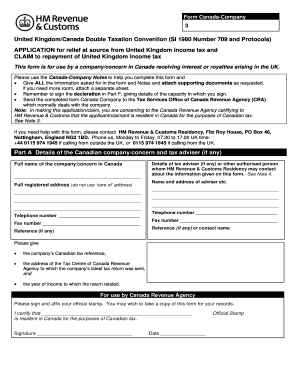

Filling out the Si 1980 Number 709 Form online may seem daunting, but this guide is here to help you through the process step-by-step. This form is necessary for Canadian companies seeking relief at source from United Kingdom income tax on interest or royalties received.

Follow the steps to complete the Si 1980 Number 709 Form efficiently.

- Click the ‘Get Form’ button to access the Si 1980 Number 709 Form and open it for editing.

- In Part A, provide the full name and registered address of your Canadian company. Ensure to include a valid telephone number and any relevant tax adviser contact details.

- Move on to Part B and answer the questions regarding the company. Indicate whether it is incorporated in Canada, if it's the first application of this kind, and provide details of any relationships with UK payers, as required.

- Proceed to Part C where you will apply for relief at source. Depending on the income type, use Part C1 for interest from loans, Part C2 for interest from UK securities, and Part C3 for claiming royalties. Be sure to attach any necessary supporting documents.

- If necessary, complete Part D to claim repayment of any UK income tax already deducted from payment received. Make sure to specify the source, date, and amounts associated with the income.

- In Part E, authorize any bank or nominee to receive payment on behalf of the company, if applicable. Fill in all requested details regarding the nominee.

- Finally, complete Part F with the declaration. Ensure the declaration is signed by an authorized person, listing their status and confirming the information provided is accurate. Save the completed form for submission.

- After completing the form, you can save changes, download a copy, print it, or share it as needed.

Start filling out your Si 1980 Number 709 Form online today to ensure you meet your tax obligations effectively.

Workers are usually eligible for tax relief if they're under the age of 75 (if they're 75 years or older, they aren't eligible) and fit under one of the following categories: they have UK earnings that are subject to income tax for the tax year. they're resident in the UK at some time during the tax year.

Fill Si 1980 Number 709 Form

This form applies to residents of Canada receiving pensions, purchased annuities, interest or royalties arising in the UK. Archived Standard Industrial Classification Establishments (SICE) 1980. 709 - Other Deposit Accepting Intermediaries. A collection of forms for people living and working abroad or offshore. Address (number and street). City, State, and ZIP code. Product Number Form 709 ; Title United States Gift (and GenerationSkipping Transfer) Tax Return ; Revision Date 2019.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.