Loading

Get Brass Payroll Deduction Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Brass Payroll Deduction Form online

Completing the Brass Payroll Deduction Form online is a straightforward process that allows users to manage their contributions effectively. This guide provides step-by-step instructions to ensure you fill out the form accurately and efficiently.

Follow the steps to complete the Brass Payroll Deduction Form online.

- Use the 'Get Form' button to obtain the Brass Payroll Deduction Form and open it in your preferred online editor.

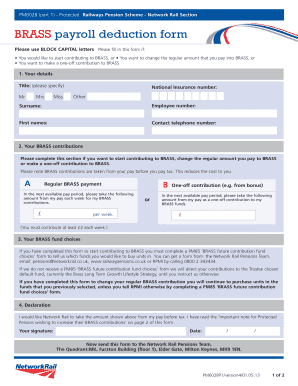

- Fill in your personal details in the section titled 'Your details'. Provide your title, surname, first names, national insurance number, employee number, and contact telephone number. Ensure all information is filled out in BLOCK CAPITAL LETTERS.

- In the 'Your BRASS contributions' section, indicate whether you want to make a regular payment or a one-off contribution. Enter the specified amount for each option, noting that the minimum contribution is £2 each week.

- Complete the 'Your BRASS fund choices' section if you are starting contributions. You must fill out a PM85 form for fund choices. If you do not indicate preferences, contributions will default to the Trustee chosen fund.

- Sign and date the 'Declaration' section to authorize the deductions from your pay before tax. Confirm that you have read the important notes regarding your contributions.

- Submit the completed form to the Network Rail Pensions Team at the specified address for processing.

- Once submitted, you can choose to save changes, download, print, or share the form as needed.

Complete your Brass Payroll Deduction Form online today to manage your contributions effectively.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The maximum contribution for the Brass Payroll Deduction Form varies based on individual circumstances and employer policies. Typically, employers set limits on contributions to ensure compliance with tax regulations. To find the exact maximum for your situation, consult your HR department or refer to company guidelines. This helps you plan your contributions effectively while maximizing your benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.