Get Bridging Loan Application Form - Slj Finance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bridging Loan Application Form - SLJ Finance online

Completing the Bridging Loan Application Form online can be a straightforward process if you follow the instructions carefully. This guide aims to assist you in accurately filling out each section of the form, ensuring that you provide all necessary information for your application.

Follow the steps to complete your bridging loan application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

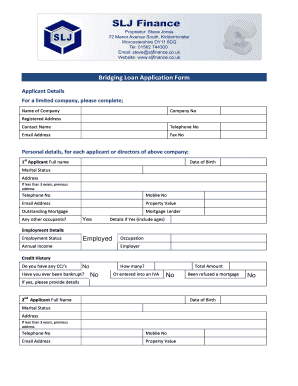

- Begin by entering the applicant details. If you are applying as a limited company, provide the name of the company, company number, registered address, contact name, telephone number, email address, and fax number.

- For each applicant or director of the company, input the following personal details: full name, date of birth, marital status, current address, and previous address if less than three years at the current location. Additionally, include their telephone number, mobile number, email address, property value, outstanding mortgage details, and mortgage lender information.

- Indicate if there are any other occupants of the property. If so, provide details including their ages.

- Next, enter employment details such as employment status, annual income, occupation, and employer information for each applicant.

- Proceed to the credit history section to answer questions regarding any County Court Judgments (CCJs), bankruptcy history, total amount of debts, and whether any mortgage applications have been refused.

- In the proposed security section, describe the property you are securing the loan against, including the address, type of property (house, flat, etc.), loan amount required, number of bedrooms, duration of the loan in months, property value, legal charge information, and the purpose of the loan.

- Specify what the funds will be used for and how the loan interest will be funded. Explain the reason for requiring the bridging loan and outline the exit method for repayment.

- Finally, fill out the solicitors' details, including the firm name, contact name, address, telephone number, fax number, email, and DX if applicable.

- Review all entries for accuracy before submitting your application. Ensure you authorize necessary credit reference searches and any other inquiries by confirming with your submission of the application.

Complete your Bridging Loan Application Form online today to take the next step in securing your loan.

Related links form

Filling in the Bridging Loan Application Form - SLJ Finance is a straightforward process. Start by gathering all necessary documents, such as proof of income and identification. Next, carefully enter your personal details, financial information, and the purpose of the loan in the appropriate fields. Finally, review your application to ensure accuracy before submission.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.