Loading

Get R85 Helpsheet 2010 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R85 Helpsheet 2010 Form online

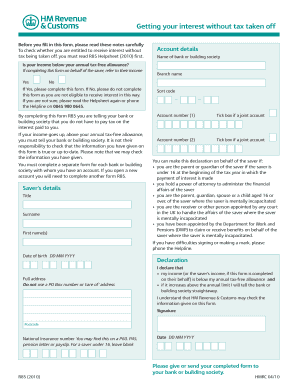

The R85 Helpsheet 2010 Form allows individuals to claim interest without tax deductions. This guide provides clear, step-by-step instructions on completing the form online, ensuring you understand each section and field.

Follow the steps to fill out the R85 Helpsheet 2010 Form online.

- Click ‘Get Form’ button to obtain the form and open it in your online document editor.

- Review the introductory notes carefully to confirm your eligibility for receiving tax-free interest. Make sure your income is below the annual tax-free allowance.

- In the 'Account details' section, provide the name of your bank or building society and the branch name.

- Where prompted, enter your 'Saver’s details'. This includes the title, surname, first name(s), and your date of birth.

- Complete the account information by entering the sort code and account number of your account. If there are joint accounts, tick the corresponding box.

- Read and answer the declaration stating that your income is below the tax-free allowance and that you will inform the bank of any increases.

- Sign the form to confirm the accuracy of the information provided. Enter your National Insurance number or leave it blank if the saver is under 16.

- Add your full address, ensuring that you do not use a PO Box number or ‘care of’ address.

- Once you have reviewed all sections and confirmed all information is accurate, save your changes. You can then choose to download, print, or share the completed form with your bank or building society.

Begin completing your R85 Helpsheet 2010 Form online today to ensure you can claim your interest without tax deductions.

The R185 form is used to claim tax relief on income from savings and investments. This form is crucial for individuals who have received interest that has already been taxed, allowing them to reclaim some or all of that tax. Understanding the R185 form is essential for managing your finances efficiently. By utilizing the R85 Helpsheet 2010 Form, you can navigate the tax relief process more smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.