Loading

Get Sarsep Fidelity Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sarsep Fidelity Form online

This guide provides clear and concise instructions on how to complete the Sarsep Fidelity Form online. Following these steps will ensure that you fill out the form accurately and avoid common errors.

Follow the steps to complete the Sarsep Fidelity Form effectively.

- Click the ‘Get Form’ button to access the Sarsep Fidelity Form and open it in the online editor.

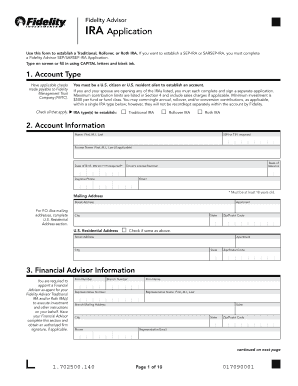

- In the 'Account Type' section, check all applicable options for the type of IRA you are establishing, such as Traditional IRA, Rollover IRA, or Roth IRA.

- Provide your personal 'Account Information,' ensuring to fill in your full name, Social Security Number (SSN), date of birth, mailing address, and contact details.

- If you are working with a financial advisor, complete the 'Financial Advisor Information' section with the advisor's firm, representative details, and necessary identification numbers.

- In the 'Funding Options' section, indicate the contribution amounts for each IRA type, including any transfers or conversions from other accounts.

- Designate beneficiaries in the 'Beneficiary Designation' section, ensuring to fill in all required fields and specifying the percentage of benefits to each beneficiary.

- Review all entered information for accuracy and completeness before proceeding.

- Once completed, save your changes, download the form, or choose to print or share as needed to finalize the submission.

Complete your Sarsep Fidelity Form online today to ensure your retirement plans are set up correctly.

To obtain your Fidelity tax forms, log into your Fidelity account online. You can easily access and download your Sarsep Fidelity Form and other tax documents from your account dashboard. If you encounter any issues, Fidelity's customer service is available to provide assistance. Keeping your tax forms organized will help you stay prepared for tax filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.