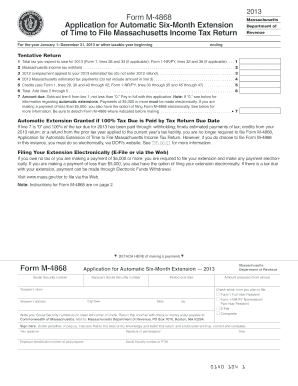

Get Form M 4868 Period End Date

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form M 4868 Period End Date online

Filling out the Form M 4868 Period End Date online is a crucial step for individuals seeking an automatic six-month extension to file their Massachusetts income tax return. This guide provides clear and concise instructions to help users navigate the form effectively.

Follow the steps to complete your Form M 4868 Period End Date online.

- Press the ‘Get Form’ button to access the form and open it in the designated editing tool.

- Enter the period end date in the designated field. This represents the conclusion of your tax year, which may typically be December 31st for most individuals.

- Fill out your name and address in the specified fields, ensuring all information is accurate.

- Input your Social Security number in the provided section, both for yourself and your spouse if applicable, ensuring privacy and security.

- Complete the 'Total tax you expect to owe' field by calculating your estimated tax due. Refer to the appropriate lines from your previous forms to ensure accuracy.

- Proceed to fill in Massachusetts income tax withheld, prior overpayments applied, and current estimated tax payments in the designated lines.

- Calculate the total amount owed by adding the necessary lines and ensuring this figure is accurate.

- If there is an amount due, submit payment electronically as required if it exceeds $5,000. Otherwise, complete any payment procedures as instructed.

- Verify all entered information for accuracy before saving your changes.

- Finalize your form by choosing to download, print, or share the completed document as needed, ensuring a copy is retained for your records.

Complete your Form M 4868 online today to ensure a smooth extension process.

Related links form

Form M-4868 is the official document used to request an automatic extension for filing your individual income tax return. This form is essential if you need more time to prepare your taxes while avoiding penalties for late filing. By filing Form M 4868, you can extend your period end date, giving you until October 15 to submit your return. US Legal Forms offers resources and templates to simplify this process, ensuring you have the correct form and information.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.