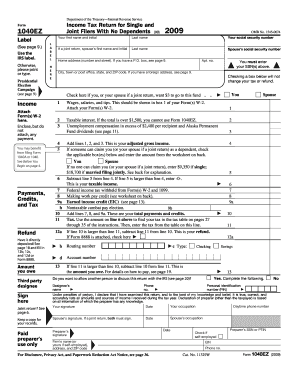

Get Department Of The Treasury Internal Revenue Service Income Tax Return For Single And Joint Filers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Department Of The Treasury Internal Revenue Service Income Tax Return For Single And Joint Filers online

Completing your income tax return online can be a straightforward process when you have the right guidance. This guide provides clear steps to help users accurately fill out the Department Of The Treasury Internal Revenue Service Income Tax Return for Single and Joint Filers.

Follow the steps to complete your income tax return online.

- Click ‘Get Form’ button to access the income tax return and open it in the editor.

- Begin by entering your social security number at the top of the form. If you are filing jointly, include your partner’s first name, initial, and last name, along with their social security number.

- Attach your Form(s) W-2 in the designated area of the document. Ensure all relevant income information is accurately reflected.

- Complete line 1 through line 3 to establish your total income. Add lines 1, 2, and 3 to determine your adjusted gross income.

- On line 4, enter your filing status. If someone can claim you or your partner as a dependent, check the appropriate box and provide the corresponding amounts from the worksheet.

- If no one can claim you, enter $9,350 if single or $18,700 if married filing jointly on line 5. Subtract line 5 from line 4 to calculate your taxable income on line 6.

- Using your adjusted gross income, refer to the tax table to find your federal tax amount and enter this on line 10.

- On lines 11 and 12, calculate any payments or credits, such as federal income tax withheld and the earned income credit, and determine if you will receive a refund or owe additional taxes.

- If you would like to have your refund directly deposited, fill in lines 12b, 12c, and 12d. If applicable, check the box indicating that Form 8888 is attached.

- Sign and date the form at the bottom. If filing jointly, ensure your partner also signs and dates the document.

- After completing the form, review it for any errors. You can then save your changes, download the completed form, print a copy for your records, or share it as necessary.

Complete your income tax return online today for a smoother filing experience.

One common mistake is failing to report all sources of income, which can lead to penalties. Another is overlooking eligible deductions and credits that could reduce tax liability. Additionally, not using the correct Department Of The Treasury Internal Revenue Service Income Tax Return For Single And Joint Filers form can complicate the filing process. To avoid these errors, consider using USLegalForms for a thorough and user-friendly experience.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.